Gold bugs can always find a reason to buy gold, but the best reason to own gold is because we are entering another commodity bull market. The precious metal is typically the first to move. Gold is a great inflationary hedge! I know what you’re thinking. Gold rallied $1,280 to $1,450 on a “dovish” Fed. Gold rallied the idea that the Fed is concerned about the global economy. It’s true that gold is a safe- haven trade. It’s also true that U.S. Dollar weakness has contributed to the gold rally and that a “dovish” Fed was the catalyst of the rally. However, gold rallies take on a life of their own. Gold is that rare commodity that creates greater demand as prices move higher. Typically, higher prices in commodities are how we curb demand to ration supply. The opposite is true for gold. The higher it goes the more people NEED to own the precious metal.

The closer we get to next week’s highly anticipated rate cut by the Fed, the more traders begin to question whether or not a rate cut is appropriate based off of the “data”. The U.S. economy is not in need of stimulus!

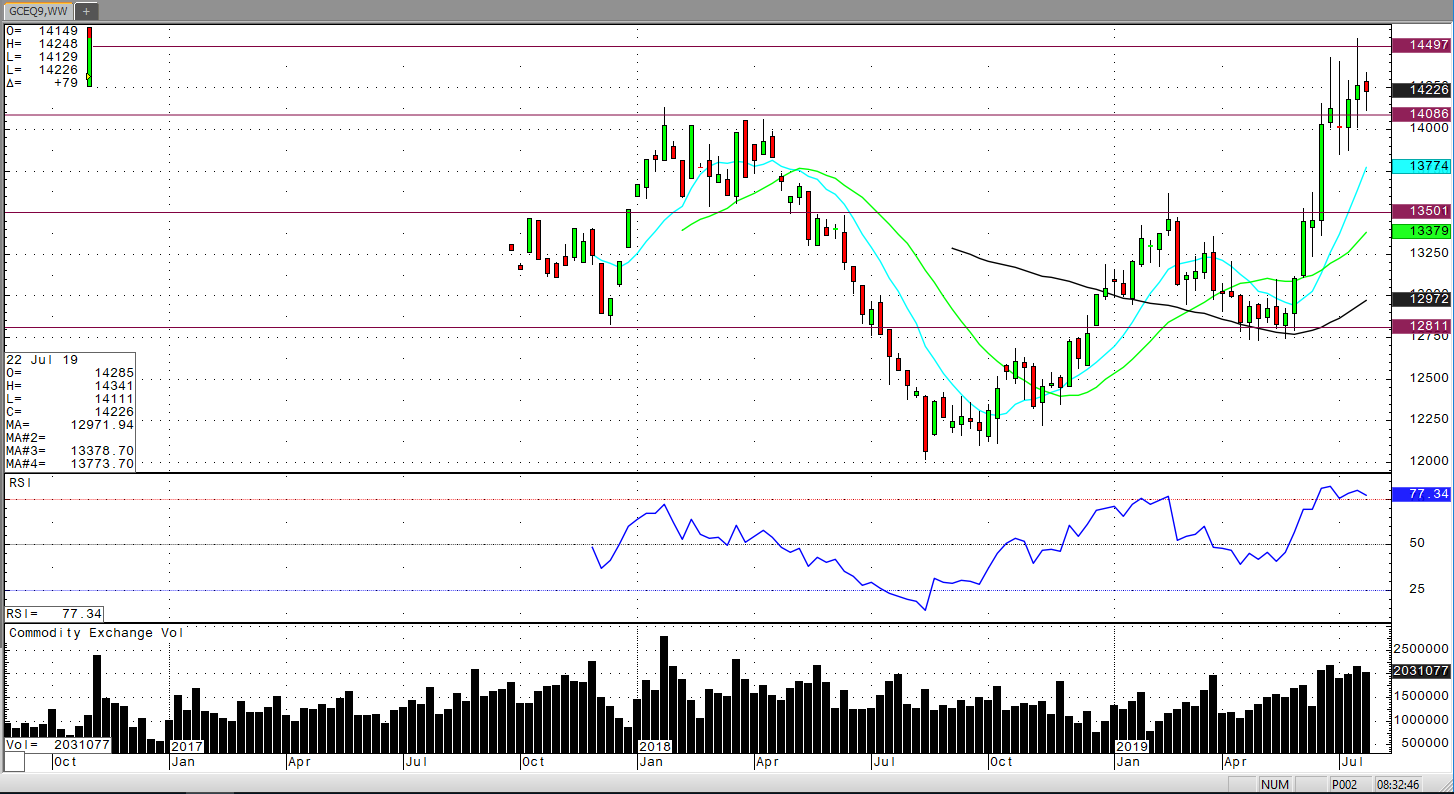

Gold is consolidating for the time being and waiting to get past next week’s FOMC meeting. So, you can talk about safe-haven trade, currency trade or inflationary hedge, it doesn’t matter as long as the price of gold is moving higher, people will continue to buy. Just use the charts to determine when to enter and exit…or add.