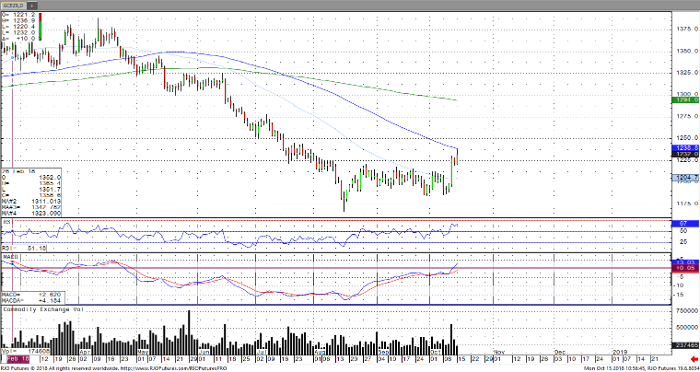

Gold is continuing to extend its rally in the early session, coming off a 10 week high in the overnight amid declines in global equity markets as well as increased tensions between the U.S. and Saudi Arabia after the disappearance of a Saudi journalist. The precious metal has garnered support as a safe haven asset bouncing almost $30 an ounce last week amid the selloff in U.S. equity markets. The technical buying, rotation out of stocks as well as a pullback in the U.S. dollar has lifted prices. Gold remains in a bearish trend, however, the recent upside move alludes to the idea that a longer term bottom may be in place. Look for the precious metal to trade sideways to higher in the near term with the next upside target seen around 1250 and then near the 200 day moving average at 1293.

Gold December ’19 Daily Chart