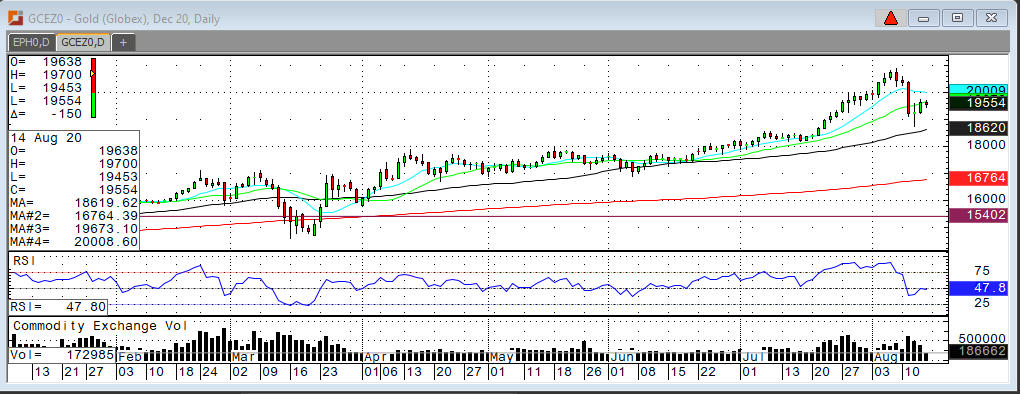

No market can just go straight up without any interruption. Yet, that is what gold did for three straight weeks, moving from $1,820 an ounce to $2,076 an ounce. So, one can easily make the case that gold was “overbought”. The market added 14% premium to a $1,800 commodity in three short weeks. He gold rally reversed on August 7th. That’s a classic “key reversal” on the daily chart. New all-time high got rejected early in the session and closed lower than the previous day’s low. That was our sell signal, or at least a warning to tighten stops and purchase Put protection.

Healthy markets go through corrections. This pullback is just a correction and the market is likely to consolidate around the $2,000 taking a little breather before continuing to march forward taking out $2,100. The reasons why I feel so confident about the continuation of the gold rally is that fiscal stimulus isn’t going away any time soon. Debt is ever mounting. The Dollar is weakening, and we’ve never lived in a time of greater “uncertainty”!

Volatility is high. Risk management is critical. Working with a professional is advised. Puts work!