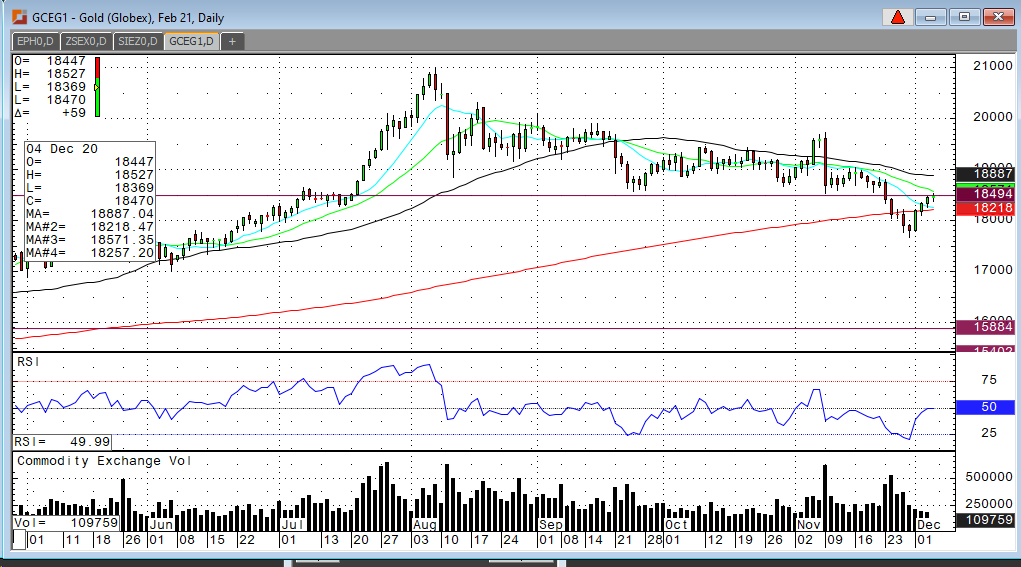

In my last update I discussed that gold was under pressure with risk on trade and vaccine news. Since then the $1,850 level and then $1,800 level were both violated. The selloff spiked down to $1,762 and bounced back very quickly. I expect that now we see gold consolidate in the range of $1,850 to $1,875 before ultimately moving back above $1,900.

Now, in my mind the whole reason that gold reached as low as $1,762 was due to a huge flow of money into BTC! I personally don’t understand that but that’s what happened. I’d rather own something that I could touch! So, gold had a sharp selloff and an equally sharp recovery bounce. That is because the Dollar is weak. The Dollar will continue to be weak. You’ve heard what they’re calling it now…”Modern Monetary Theory”. Easy money, Fiscal Stimulus, Printing Money, Quantitative Easing all add up to the same thing. Debasement of the currency. This is why I will remain bullish on gold. Inflation will be unavoidable.