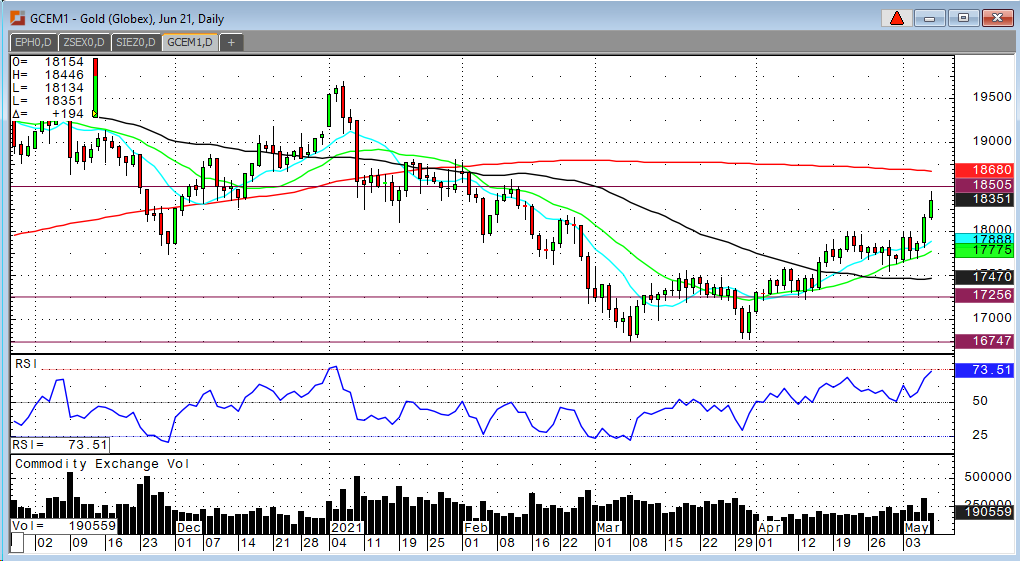

Gold futures had a definitive break out to the upside yesterday. Early in the session this morning seems to be confirming that the breakout is real. A close over $1,820 is necessary today. A close over $1,840 would be very strong.

I don’t think that you can look at commodity prices and NOT see inflation. Energy markets, agricultural markets, copper and lumber are all inflationary and this is not just transitory. This is not like last year’s toilet paper shortage! It’s the real deal inflation beginning to heat up. Gold is continuing to climb away from the $1,675 lows. Another period of consolidation would be in order after this type of break out. The 10 and 20-day moving averages are pointing higher and beginning to fan out. The 50-day moving average looks like it’s about to curve upward now too. The next big level to watch is the 200-day moving average which is at $1,868. Some sideways between $1,825 to $1,850 is more likely over the next week or two.