With the sharpness and degree of Monday’s follow through selloff from last week’s seventy-five-dollar correction we can say the market was extremely over sold and that this bounce was in order. However, one could also say that a retest of Monday’s low is a likely scenario and that this recovery bounce is another opportunity to sell gold. Keep an eye on the US Dollar. The Dollar has been capped by good resistance at .9320 recently. If the Dollar breaks out above .9320, gold will slide back to $1,700 pretty easily. Also, keep in mind that the gold market was spooked by talk of tapering and we continue to see inflationary data that should prompt gold traders to pressure the market down again.

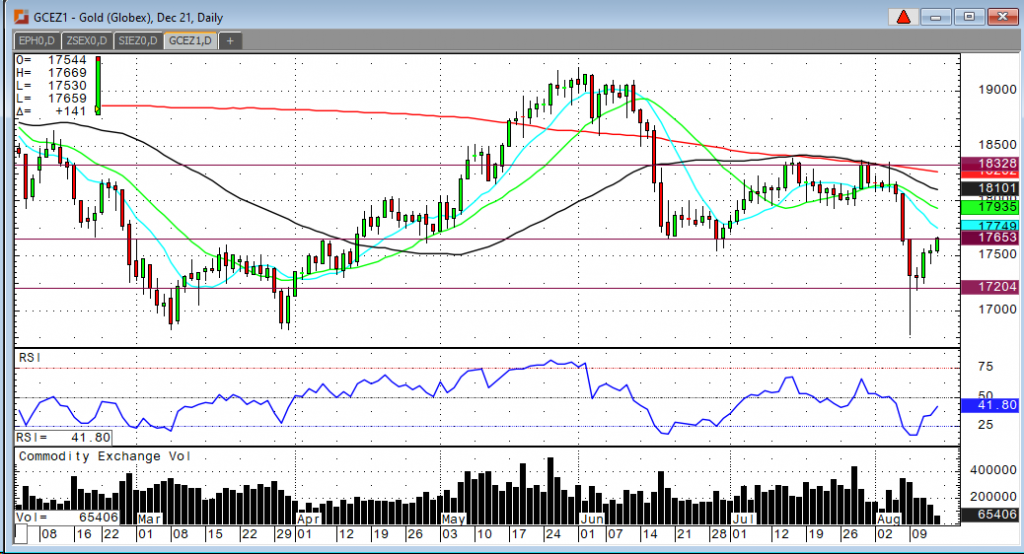

As I like to point out, “it’s usually just a level on the chart, that turns the market around.” Having said that, I see $1,765 as “old support, becomes new resistance.” Just look at the daily chart below. If gold can manage a close above $1,775 that would be friendly to the gold bulls. A drop below $1,742 would indicate a continuation of the short term down trend. Below $1,720 is bearish.