Safe-haven trade? Currency trade? Inflationary hedge? How about the technical trade, since most disciplined traders use chart action to determine when to get in or out of a trade. Last year between mid-August through mid-October the gold futures based a long-term bottom at the $1,200 level. So, in roughly four months’ time, gold futures have rallied $125.00. That’s a trend. Now the fundamentals behind the big sell-off to $1,200 and the subsequent big rally was totally driven by the Fed. From an aggressive rate hiking forecast to literally slamming on the brakes on rate hikes.

I’m here today to make a new call on gold futures that will fuel the next big rally! Fundamentals take time to change but I see two very compelling fundamental changes coming that will, in my opinion, drive gold prices back towards the $1,400 level. Gold production is down! That’s what happens when prices get too low. Secondly, we beginning to see increased demand in the precious metal for whatever reason…it doesn’t matter. Now here is what separates gold from other raw commodities. The higher the price goes the more that demand will increase and at a much faster rate than production can possibly increase. Gold is that one commodity that cannot curb demand with higher prices!

So just to recap recent moves in gold. Down on Fed rate hikes. Up on Fed pause in rate hikes. Next move up on “real” supply and demand fundamentals. Tight supplies and increasing demand can last much longer than recent Fed driven action. Long term bull market returning to gold futures.

If you would like to learn more about metal futures, please check out our free Fundamental of Metals Futures Guide.

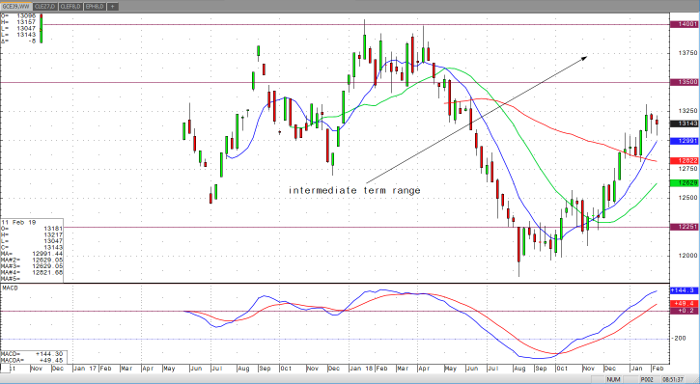

Gold Apr ’19 Daily Chart