This morning’s non-farm payroll data came out about as bad as could be expected. What was forecast to be a number between 130,000 and 200,000 with a consensus of 175,000 came out at only 20,000. January was revised higher by 7,000, but that still leaves us quite a bit shy of what traders were looking for on the day. It wasn’t all doom and gloom though as there were a few silver linings. The unemployment rate dipped down 0.2% to 3.8%. We also saw average hourly earnings rise by 0.4%, which brings the year-over-year gains to 3.4%.

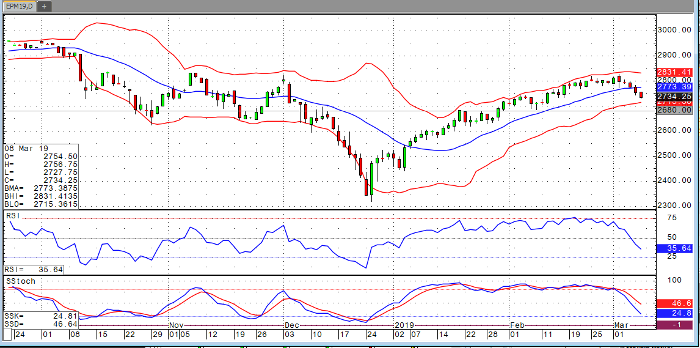

As one might have expected, stocks did not take the news very well. Following yesterday’s weakness, stocks continue to dive with the three major indices all down at least 0.8% in the early going. Most technical indicators are forecasting more downside. The next level of support on the June e-mini S&P is at 2680. Beyond that, we’re looking at about 2625.

Next week features a decent slate of news. Retail Sales, CPI, PPI, durable goods, and new home sales are some of the highlights. While traders will be watching those numbers closely, most will be looking forward to the FOMC meeting beginning on the 19th. We’re not expecting any rate adjustments this time around, but it will be interesting to see if the dovish shift continues to gain momentum.

E-Mini S&P 500 Jun ’19 Daily Chart

If you would like to learn more about S&P 500 futures, please check out our free Trading E-mini S&P 500 Futures Guide.