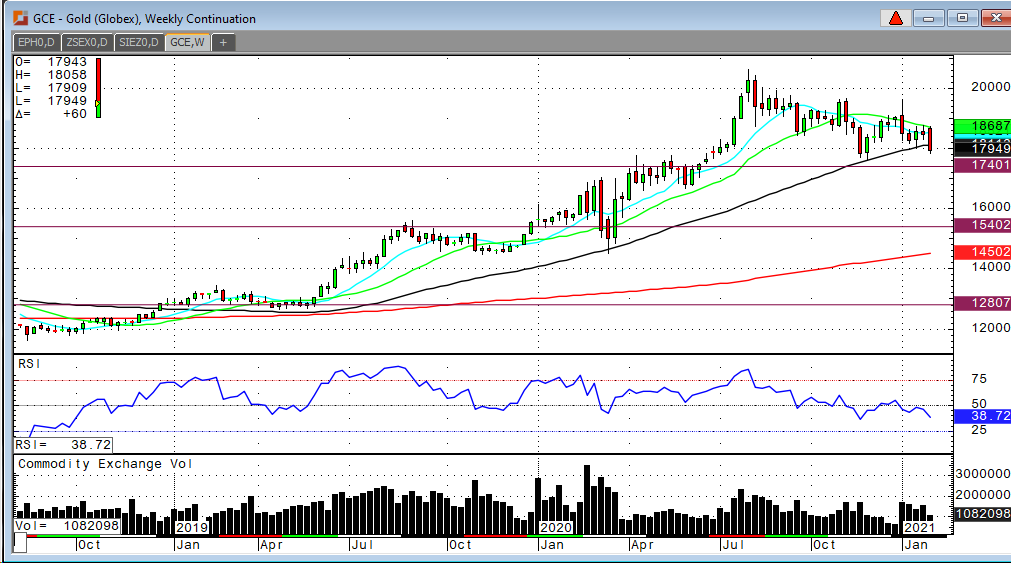

It looks likely at this point. Saying so isn’t such a bold statement. The US Dollar has been able to hold levels above .9100 all week. So far $1,785 has held and I discussed this range of $1,800 to $1,785 in my last report. We are currently at a level where the gold bulls will really need to step up and quickly retrace levels back to $1,850. I’m thinking that if there’s too much hesitation to recover quickly from here that the path of least resistance remains down. If somehow the Dollar reverses and moves back below .9100 then that would support gold prices recovering. However, I’m thinking you’ll be able to enter on the long side at lower levels in the range of $1,750 to $1,740 for the April contract.

US Treasury Futures remain weak and Equities remain strong. Energy markets are very strong. These are “risk on” trades and regardless of the reason behind these trades, they’re not good for gold. There’s ne reason for the safe-haven trade. The currency trade isn’t working, and we’re just not yet ready to embrace the inflation trade for gold. There is inflation out there. You can see it in other markets. Don’t give up on the gold trade, but a patient approach is recommended.