Shots fired yesterday in the jobless market. U.S. jobless claims rose 70K to a 4yr high of 281K. This data could grow 10/20 fold in oncoming weeks and that’s not an exaggeration. Be engaged with our ranges, because bounces in stocks/commodities that are listed as “bearish trend” are likely to fail and be shorting opportunities. However, we do think energy is buyable in this environment from the low end of the range (yes we know its bearish trend), BUT we definitely see swing trading opportunities in crude from the these multi DECADE levels.

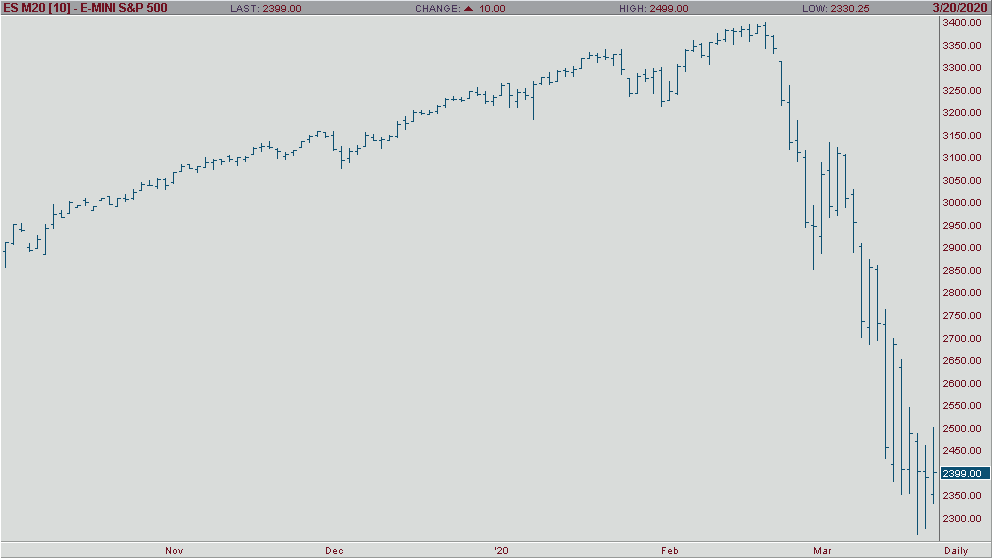

Stocks- Look for possible sell opportunities off bounces, preferably at the top of the range. VIX has come off the highs to 68.00 and yields are backing off again this morning. This could give stocks a few days of “bounce” , but they will likely be opportunities to catch the next leg lower.

Oil- we said it up top, good swing trade opportunities from multi-decade lows. Manage the range and keep an ear the ground for rumblings out of OPEC

Metals- I do think there could potentially be another wave of selling that hits the metals – but we think it’ll likely be the LAST. Tremendous upside in metals, but may shake out one more time. Dollar devaluation is likely at some point as markets quell the fear and attempt to recover – this is your gold/silver catalyst to watch for. 1400-1558 Gold and 11.53-14.07 in Silver