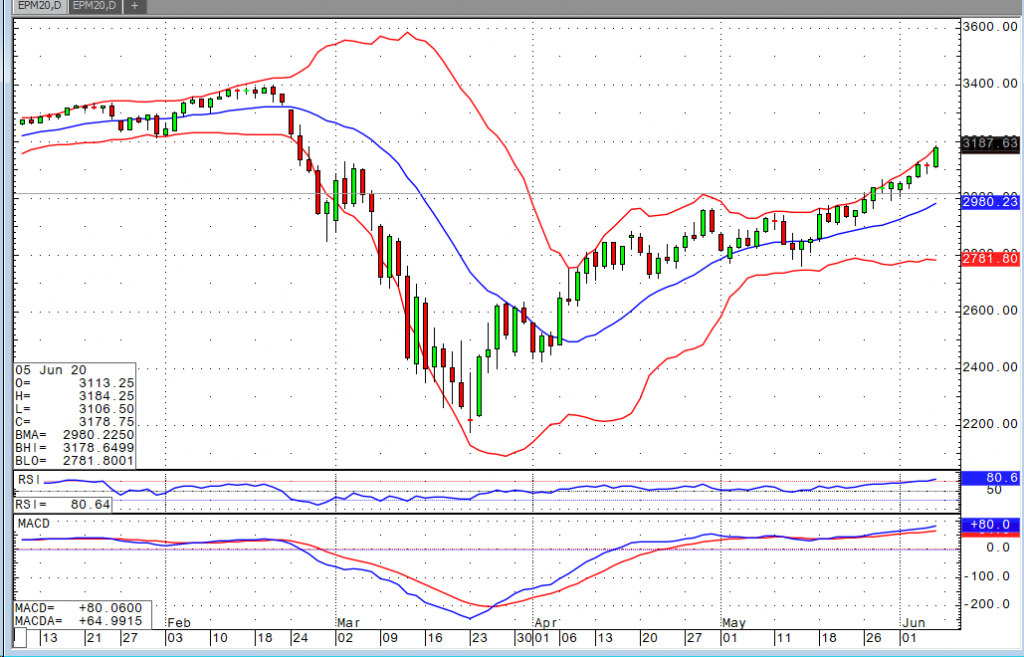

This morning’s non-farm payrolls data were expecting to see a figure in the neighborhood of -7.7M and an unemployment rate of about 19.8%. Instead we added 2.5M jobs (about 3.1M of that was private payrolls w/ the losses largely coming from local government jobs) and saw an unemployment rate of 13.3%. It is safe to say that while stocks have discounted most, if not all, the bad news that you see or read about, but it did not expect this kind of number. The Dow is up 700 (2.65%), the Nasdaq is up 130 (1.37), the S&P is up 63 (2%), and the Russell is up 55 (3.77%). It is hard to say where this number takes us with the other indices, but the Nasdaq has now eclipsed the pre-shutdown highs.

The market has come back to an incredible degree in a very short period. I can understand the stance that we are due for a pullback given all the headlines out there. However, you could also argue that we’ve seen the pullback that everyone was calling for prior to the shutdowns. If we continue to see data anywhere near what we did today, a selloff of significance becomes increasingly unlikely.