This morning’s nonfarm payroll data came in strong at 263K versus and expected 181K. The biggest news of the release was that the unemployment rate dropped to 3.6%. That is the lowest reading since December of 1969. As you might have expected, stocks have rallied on the news. The Dow and S&P are up over 0.5%, while the Nasdaq is currently 0.8% higher. We’ll see if the number will allow us to make another run for all-time highs, but for now it has at least pumped the breaks on the downside momentum that began on Wednesday.

This reading should help fuel the debate about interest rates. President Trump and others in the administration have been very forthright about their desire for lower rates. However, many are arguing that with data continuing to come out without a whole lot of cause for concern, a rate cut is not warranted. We’ve got a fairly active news slate for a Friday to fill out the remainder of the trading session. Along with several speeches from FOMC members, ISM will be released shortly.

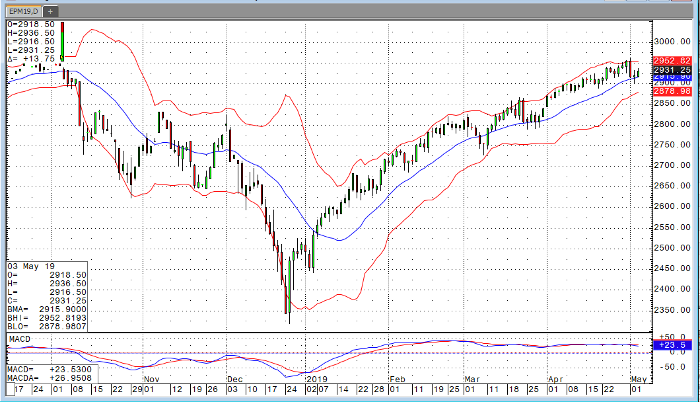

E-Mini S&P 500 Jun ’19 Daily Chart