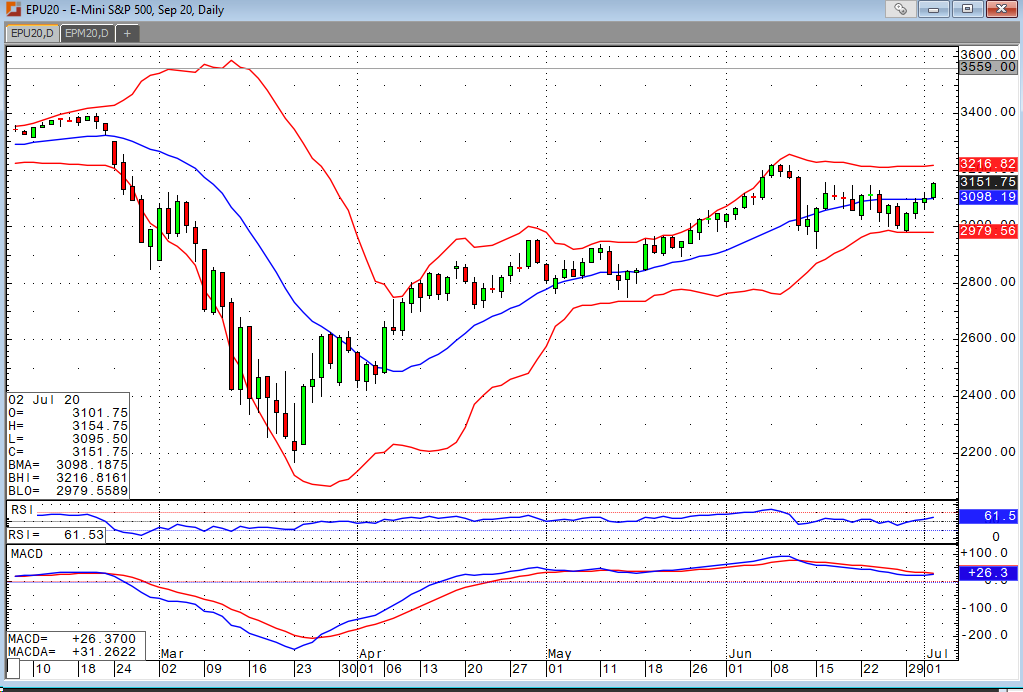

The most hated rally in recent memory continues to power on. I get it. Things aren’t exactly rosy out there. However, the market continues to discount the perceived risks, and we’re up roughly 1.5% in the four major indices. Consensus expectations for this morning’s nonfarm payrolls was 3,000,000. We saw a number of 4,8000,000 and an upward revision of last month’s number from 2,509,000 to 2,699,000. The unemployment rate, which was anticipated to come out at 12.4%, was reported at 11.1%. Private payrolls and manufacturing jobs were huge contributors. The private sector added over 4.7M jobs vs. expected 2.66M. We also had a revision on last months number of an additional 138k. Manufacturing jobs increased by 356k vs. an expected 180k. There was also an upward revision ther of an additional 25k manufacturing jobs in last month’s number. On the flip side, we saw average hourly earnings dip by 1.2%.

The Fed is doing all they can to support the economy. There is a legitimate argument about who is benefiting from their actions, but that’s a conversation for another day. The bottom line is that betting against the Fed has been a tremendous way to lose money over the years. It’s hard to say where all this will stop. The virus is obviously the biggest headwind here. The concerns are legitimate, but the market seems to be optimistic about the prospects for a vaccine. Suppose we have one in the next six months. My biggest question is whether or not that has been priced in, or if we’ll end up having to chase the market at higher levels as a result. Dip buyers continue to get paid in the interim.