**CPI +0.4% m/m vs 0.1% previous; 8.2 y/y; Core y/y CPI rises to 6.6%

**PPI +0.4% m/m vs -0.2% previous; 8.5% y/y

**Initial Claims rises to 228K vs 219K previous

**JPMs Dimon issues another warning about markets and the Fed

SP500 -1.00% w/w – Stocks went on a wild ride between Thursday and Friday. SP500 traded roughly as many as 400pts from Thursday to Friday’s close.

10yr Yields: 4.02% close on Friday, levels not seen for more than a decade.

Crude Oil -7.50% w/w following an +16% week off of the OPEC production cut announcement. Crude Oil seems to be more focused on demand side fundamentals rather than the historically tight supply conditions

Gold -3.52% – strong dollar and rising bond yields continues to dominate Gold prices

Top Headlines:

**China asks top LNG importers to halt resales to foreign buyer

**China urges citizens to leave surrounding areas of Ukraine

**Less than 175 bps of BOE hikes priced by year-end vs 280 bps peak

**Traders pare BOE wagers, see key rate peaking at 5.36% by May

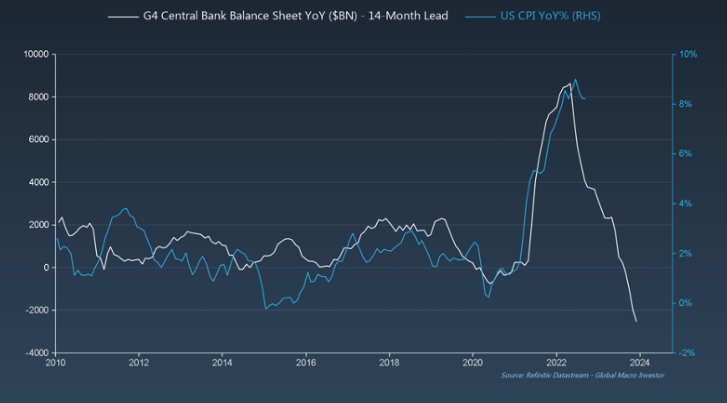

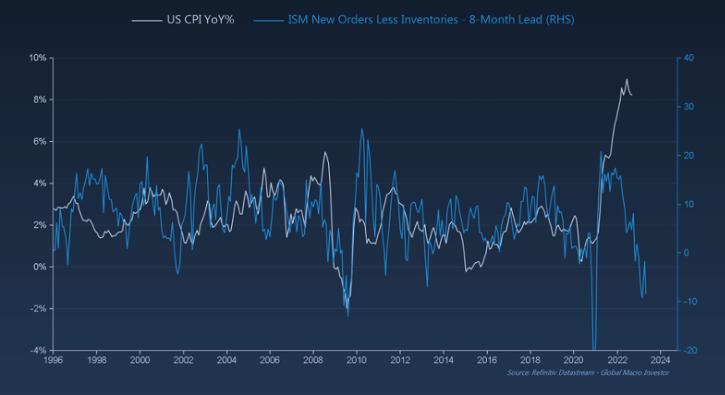

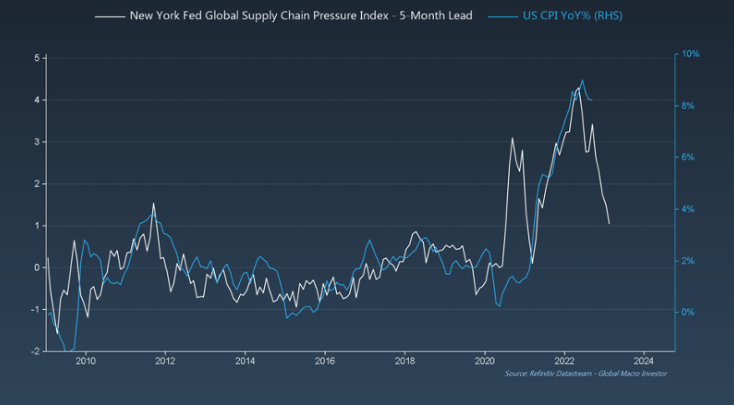

Last week was clearly dominated by the inflation headlines with CPI glued to nearly 40yr highs, and Core CPI continuing to accelerate. Pretty starling data, however CPI operates on a severe lag, and is really telling a story of what inflation looked like roughly 6 months ago. This weekend I caught some fairly compelling information published by the “Global Macro Investor” that suggests inflation is set to drop significantly over the next 12-18 months, and perhaps goes below the zero bound. The study showed G4 Central Bank Balance Sheet Growth, Company Inventories at record highs coupled with falling new orders, commodity prices, supply chain, and wages. Here’s just a sample of the study, but fairly compelling information.

G4 Central Bank Balance Sheet Growth has CPI below 0% by 2024 – suggests that the Fed has overtightened.

*Source: Global Macro Investor

ISM New Orders. Inventories are at record highs, coupled with falling New Orders, which leads to price cuts

This chart shows the diverging CPI data with New Orders

*Source Global Macro Investor

Global Supply Chain Pressure suggests CPI will be headed LOWER in months to come

*Source Global Macro Investor

So what does this all mean? Of course it makes a strong argument for falling inflation pressures over the next 6-12 months. We’ve already made the call that US GDP is on the precipice of dropping significantly in coming quarters, and that will also weigh heavily on inflation. The Fed is firmly focused on CPI data, which we’ve made the case is a LAGGING indicator, and that the risk of them overtightening has already taken place! The bond market continues to diverge from the business cycle – this has happened in prior years such as ’94, ’00, and ’14, after which each episode saw a very dramatic fall in yields!

Good Luck this week!

Disclaimer:

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results.