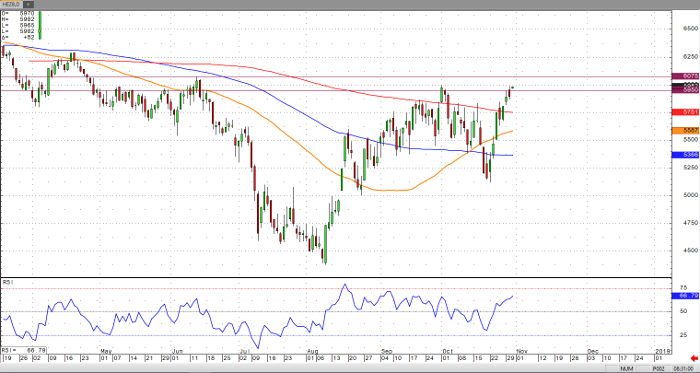

The December lean hog prices rallied this past week, leaving the futures to a more normal discount to the cash market and a narrowed basis. Friday, we saw a rally through the 200-day moving average and close above 58.00. In the near-term, there looks to be weak export demand with record production and high levels of cold storage stocks. Monday, the market opened and gapped higher, but failed to fill the gap that day, eventually closing higher. Yesterday’s trade was down, but still failed to fill the gap from Monday’s opening.

If the market falls in the short term, I don’t see it falling through the 200-day moving average (57.50) or the 58.00 price level. The spread of African Swine Flu in China is driving up the prices of the December contract. If China were to lose 16% or more of their herd then that would equate to all the global trade in pork for 2017. On a technical basis, there is positive momentum now, but it looks that we are in overbought territory with the RSI number starting to creep up to the 65 number (currently 63.62). A breakthrough and close above the 59.50 price level should test the second resistance level of 60.75. It looks that the opening will be higher in the Dec hog contract and I could see this market breaking through $60 price level due to the continued outbreak of ASF.

Lean Hogs Dec ’18 Daily Chart