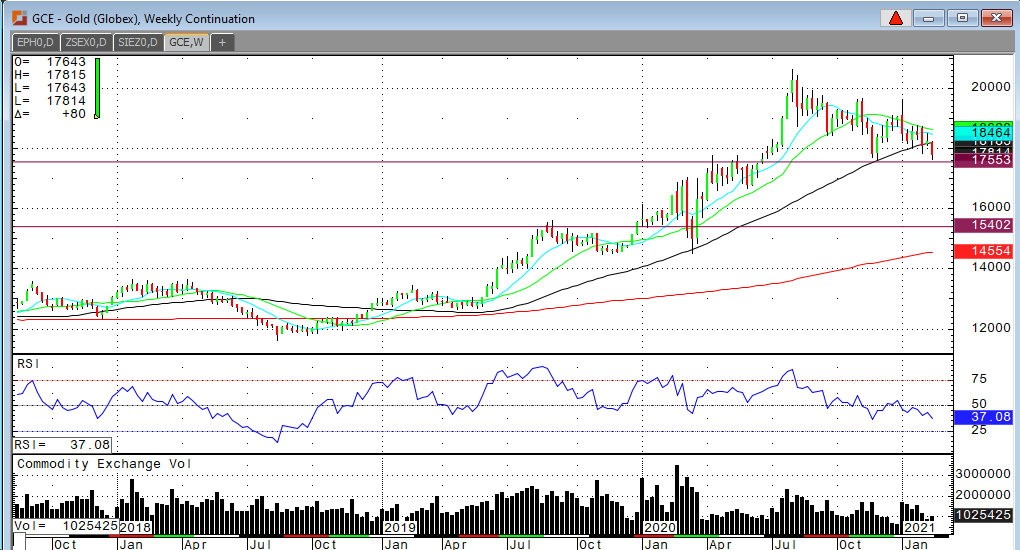

I’ve been calling for a test of this chart level for the past few weeks. Now I look for a period of consolidation in this area around $1,750. Dollar weakness will help to stabilize gold prices. Other metals experiencing sharp recovery bounces off overnight lows. These are eight-month lows in gold while platinum is at multi year highs and silver holding steady with levels above $27.00. All along I’ve also been calling for silver and platinum to “normalize” their price ratios with gold. That is happening.

I’m not about to give up on gold, but gold has run into significant headwinds. Gold for now has lost its safe-haven trade. Rising interest rates hasn’t made gold more attractive and then there’s the debate over Bitcoin replacing gold…which I’m not buying. Gold will recover and be closer to $2,000 buy year end in my opinion.

The Fed is committed to heating up the economy which will continue to open as vaccines are distributed. The Biden Administration is determined to push through more and more spending. The dollar will resume its down trend. Inflation will happen. There’s too many dollars out there and the bond market is telling us that’s too.