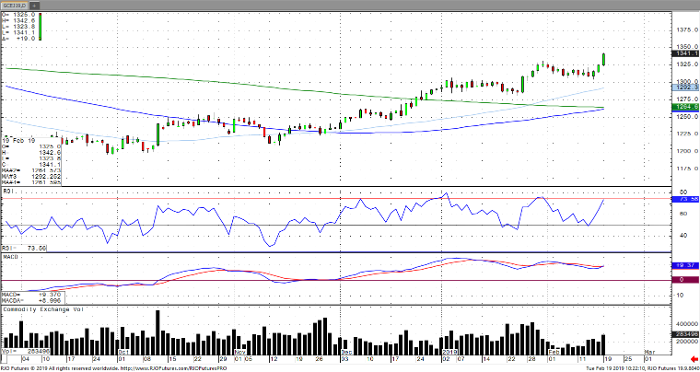

Gold has extended its upside move this morning and is trading at a 10-month high. This comes amidst some speculative buying as well as monetary policy easing by some of the world’s major central banks. The rally in the precious metal has been impressive given the sustained strength in the U.S. dollar, although the dollar is coming off a two month high this morning. The Federal Reserve’s FOMC minutes are set to be released Wednesday afternoon, which will only reinforce the dovish tilt and posture in monetary policy. Global demand has increased over 4% with central bank purchases leading, according to the World Gold Council. Geopolitical uncertainty in the UK as well as across Europe and coupled with ongoing U.S.-China trade talks should continue to provide underlying support. Gold remains bullish trend with the next upside target seen around 1355 with resistance expected around 1350.

If you would like to learn more about metal futures, please check out our free Fundamental of Metals Futures Guide.

Gold Apr ’19 Daily Chart