*PCE data on Friday came in a tad mixed with Core PCE beating by 1/10th at 2.9% vs 3.2% previous, spending higher +0.7% vs 0.4% previous, and MM prices 0.3% vs 0.4% previous.

*Markets continue to price in 5/6 rate cuts vs the Fed’s projection of 3 – this is the “risk” spread we’ll call it. Market expectations vs Fed projections … does the Fed meet the market or is the market getting ahead of itself? These questions will get answered perhaps this Wed in Jay Powell’s press conference following the FOMC announcement.

*Improvements in the profile of volatility (VIX) – more below

*Commodity Performance Last Week

-Gold -0.60% (+0.52% to start this week)

-Silver +0.70% (+1.15% to start this week)

-Copper +1.9% last week

-Crude Oil +6.2% last week

-RBOB Gas +7.3% last week

*Heavyweight Week on deck in terms of Economic and Earnings Data:

-MSFT, GOOG, AMD report on Tuesday after the bell

-Consumer Confidence on Tuesday

-FOMC Announcement on Wednesday followed by Chair. Powell’s Press Conference (we’ll have a report out on Fed expectations tomorrow)

-AAPL, AMZN on Thursday after the bell

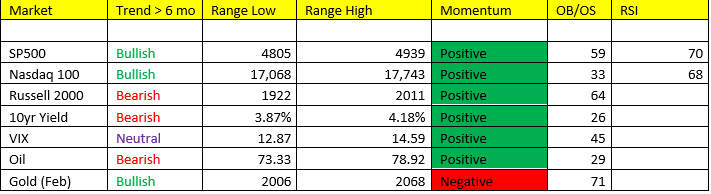

Stocks: modest gains for the major indices, SP500 +0.80%, Nasdaq +0.62% but fell late in the week, and R2000 +1.4% WW. For the month SP500 and Nasdaq are +2.50% and 2.96% respectively, and continue to build on last year’s gains, however February looms. Since 1928, only 3 months have produced an avg annual loss for the SP500 – September being the worst performing month, followed by February, and May. We’ve noted the profile of volatility having changed in late December and that still hold today, VIX currently +5.13% in the pre-market on Jan 29. More volatility is likely ahead as we close out Jan and move into February. Our technical/seasonal analysis coupled with cycle analysis suggests an elevated and rising probability of a correction of 3-5% correction that likely lives between now and May, or 150-245pts in the SP500. We’ve mentioned the “risk spread” bw market expectations vs Fed projections on interest rates.

Gold: We’re rolling out of all of our Core Feb Gold positions between today and tomorrow, we’ll get in touch with you. Gold per our analysis is due to form a low and turn back to the upside. However, the best period for Gold, per our analysis suggests perhaps the 2nd half of 2024 – that could push price north of 2200 an oz. This trend could live in and around the time of the first rate cut by the Fed – we think May/June time frame is where the first rate cut will happen.

*Oil: A low looks to be in for Oil prices following last weeks 6% surge. Likely another hit back on the downside, but that should present a buying opportunity.