We had a surprise FOMC meeting yesterday if you didn’t notice. Jay Powell testified before the House Fin. Committee yesterday and removed all doubt about the Fed’s intentions on Mar 16th (FOMC Meeting). Powell told the committee he will be supporting a 0.25% interest rate increase (Less Hawkish) – that’s not 0.50%. So naturally stock bulls took the news and ran with it – SP500 finished +1.9% for the day and immediate OB, and closing in on the top of the range. Jay Powell also mentioned that they may have to be “nimble” in terms of responding to future data and geopolitical events – LESS HAWKISH, actually DOVISH.

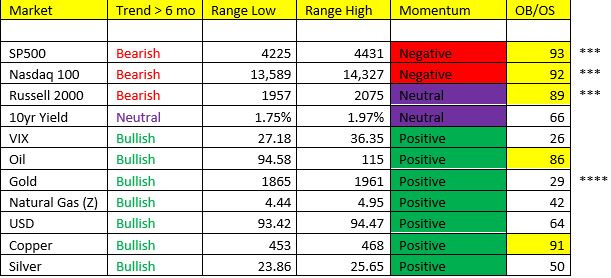

Yields rose steadily through yesterday’s session, following their elevator style drop from > 2.00% to 1.68% on Tuesday. I remain Bullish of bonds, holding core longs, and will look to gross those UP as we potentially move back towards the top of our range, which is a LOWER HIGH – as you can see below.

Gold- giving me a positive divergence – a very strong intermediate term trend – upside to 1961/downside to 1865. BULLISH, POSITIVE, and Nowhere near OB at the moment. One of the technical strategists we use, is suggesting another pull-back in oncoming weeks – hold a small presences here, but don’t chase this market is my current recommendation.

Agriculture- Rip risk rally’s in grain over the past 2 weeks – we’ve seen this type of activity during past “wars”. Most recently 2014, the invasion of Crimea. These rally’s are typically temporary. If history has shown us anything, its that Ag prices don’t stay at these levels for very long. Scenario 4 looms (disinflation) in Q2 2022.

This is a certainty: Oil prices at 115bbls, Ag prices reaching decade highs, IS NOT BULLISH FOR US GDP. US Growth is about to take a serious hit in the 2nd quarter.

Data: ADP +475K yesterday vs. 400K expected – I wouldn’t read into this too much as we’ve seen stark contrasts bw ADP and NFP for the past several months. Tomorrows NFP we’ll be looking for 400K vs 467K.

Jobless Claims : 215K down from 233K prior, continuing claims ticked higher to 1.476M.

ISM Services due up later in the session/Jay Powell cont’s his testimony on Capitol Hill.