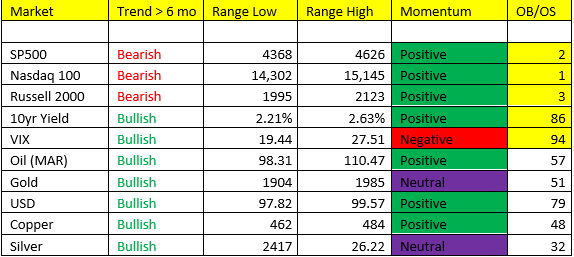

Stocks: gave back all of Monday’s gains yesterday, and then some today. Lael Brainard, typically the most “dovish” member of the Fed came out dressed as a “Hawk” yesterday. On top of this we came in to yesterday with heavy/increasing IVOL discounts, and of course we’re in Scenario 4 Growth slowing and the Fed is tight. Carrying core shorts in Nasdaq and Russell – I’ll gross up on OB and de-gross on OS – that’s how I’ll play this. The Fed minutes are out later today – although following yesterday’s Brainard speech yesterday, the market may have all of the info. I’ve heard some of our analysts call this perhaps the worst set ups for stocks in the last 2 decades. Stocks are immediate OS this morning – but remain bearish trend on our 3-6 month.

Dollar: a top long in Scenario 4 – I’ve heard plenty of technical strategists calling for a top in the Dollar. If we’re close to a top, it sure as hell wasn’t yesterday. It’s clear the Dollar is tracking rates higher, as the Fed continues to move the goalposts on its rate hike projections. So clearly there’s a divergence in monetary policies globally vs the US’s tightening cycle that is fueling the rally in the USD. Furthermore, the European Union is also entering Scenario 4, which is going to make it tough for the ECB to pivot to a more hawkish policy comparatively speaking to the US – this will eventually change as the Fed will likely have to pivot or pause per our call – or maybe they won’t – somethings got to give.

Bond Yields: We usually get paid here in Scenario 4 – not this time, for now at least. Following Brainard’s hawkish comments, the Fed Funds rate quickly sprung to 2.42% on the December contract – pricing in nearly 10 rate hikes. Now whether or not we think the Fed will get to 10 this year is besides the point – the bond market is now essentially doing all of the heavy lifting for the Fed’s errors in the forecasting business. The Fed has inverted nearly all durations of the yield curve, and are seemingly fast tracking us into recession. The Fed has had a fairly predictable pattern of easy monetary policy, followed by rising inflation, followed by a tightening cycle, and 10 out of 10 times, they’ve successfully sunk the economy into recession. CPI and PPI are due up early next week, Hot or “Cooling” is hard to say now, but we suspect we’re close to seeing “peak” inflation over the intermediate to longer term. Also noteworthy, 30yr Mortgage rates hit up over 5% yesterday for the first time since 2011. Again, the question remains are we fully priced in, or is there more to go? Bonds (30yrs) are now signaling immediate OS/Yields OB this morning.

I hear the arguments

Volatility: A couple charts on VIX. Volatility saved itself, right off the trendline (Daily Chart). Conversely, stocks gave back 100% of Monday’s gains.

Are we seeing a long term shift in the regime/trend of volatility going forward? (Weekly Chart) On the left you can see the vol spikes from the pandemic in the spring of 2020, followed by suppressed/falling volatility all the way up until late November – when conditions began to change.

Good luck,