The stock indices are in the red in the wake of a jobs number that will be chalked up as a miss. All four major indices are now lower on the day, despite trading in positive territory for a bit after the open. The reading was anticipated to come in at or around 190,000, but the actual number came in a bit shy at 155,000. We also saw a small revision lower from the previous reading of 250,000 down to 237,000. One bright spot was manufacturing. The prediction was an increase of 16,000 jobs, but we actually saw an increase of 27,000. The data also showed an hourly earnings increase of 0.2%. It’s progress, but that was on the lower end of expectations as well. The unemployment rate remained unchanged at 3.7%. Consumer Sentiment came in steady at 97.5 versus an expected reading of 97.4.

Next week’s data is fairly light, but traders will be looking ahead to the FOMC announcement on the 19th. They’re expected to raise rates another quarter point and should shed a bit more light on their intentions moving forward. Recently, there has been an indication that some of the members are backing off their hawkish stance a bit. I’m assuming they’ll continue to say something about changes being data dependent, but it seems as though they’re having discussions about veering off their gradual, quarterly rate increases at some point.

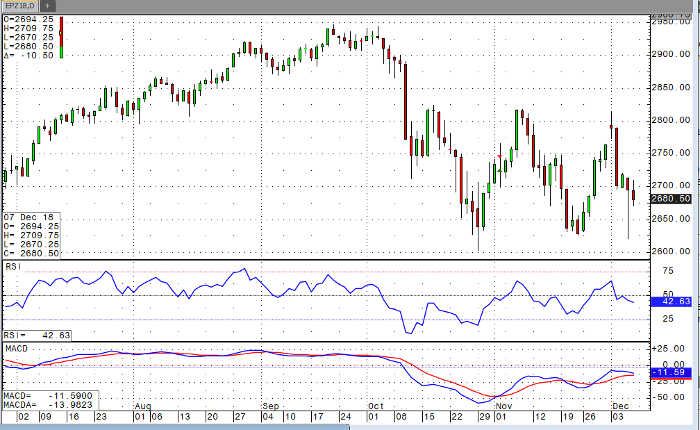

E-Mini Dec ’18 Daily Chart