Natural gas for October delivery is trading higher for the third consecutive session, bouncing back after closing down 4.8% last week. The near term weather forecasts above average temperatures in the Southwest and the Northeast regions of the U.S. The EIA Short Term Energy Outlook showed gas production fell to 87.17 bcf per day this month from 87.73 per day bcf last month. Stockpiles are forecast to fall to 3,308 bcf by the end of October, which would be the lowest level since 2005. As of the end of August, stockpiles are down 19% below the five-year average. Demand in the near term may be curtailed in the southeastern region following the landfall of Hurricane Florence. Near term resistance comes in near the 100 day moving average at 2.863 with the next upside target of 2.870 and support around 2.800.

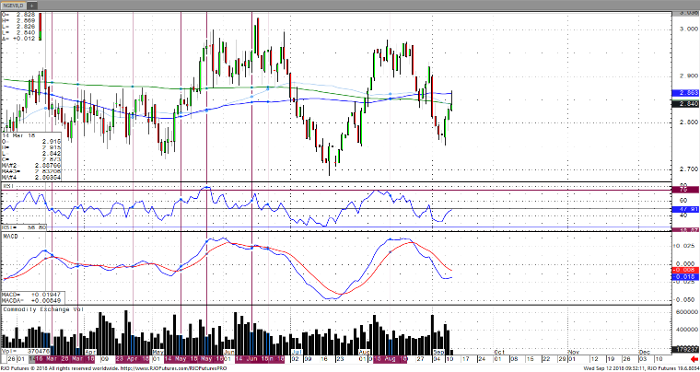

Natural Gas Oct ’18 Daily Chart