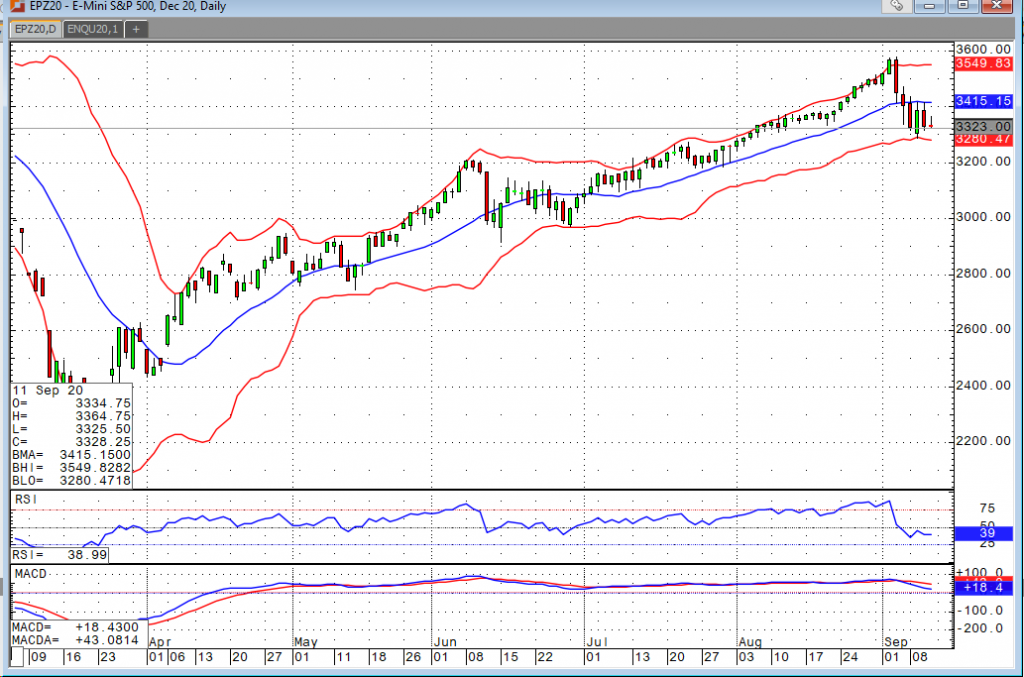

While the markets were higher in the early going today, they’re backing off, and the last few sessions have been far from pretty. Yesterday’s failure to pass another stimulus package provided the fuel that the bears needed to drive this market lower yet again. It is looking increasingly likely that there will not be a stimulus package before the election in November. Election years continue to get nastier, everything is political now, and we’ll just have to deal with it for the next seven and a half weeks. Risk has returned to the market, and it appears cash is on its way to becoming king again. Those that have been condemning the rally for months now seem to be beating their chests on the airwaves these days, calling it a bubble, talking about how badly this will end, etc. They may be right, but the selloffs (aside from the corona virus driven selloff) have tended to be pretty short-lived. That said, with the upcoming election, the FOMC meeting next week, Coronavirus cases reemerging in Europe, and so on, there is certainly plenty of reason for the dip buyers to be a little more protective of the profits they’ve accumulated over the last several months.