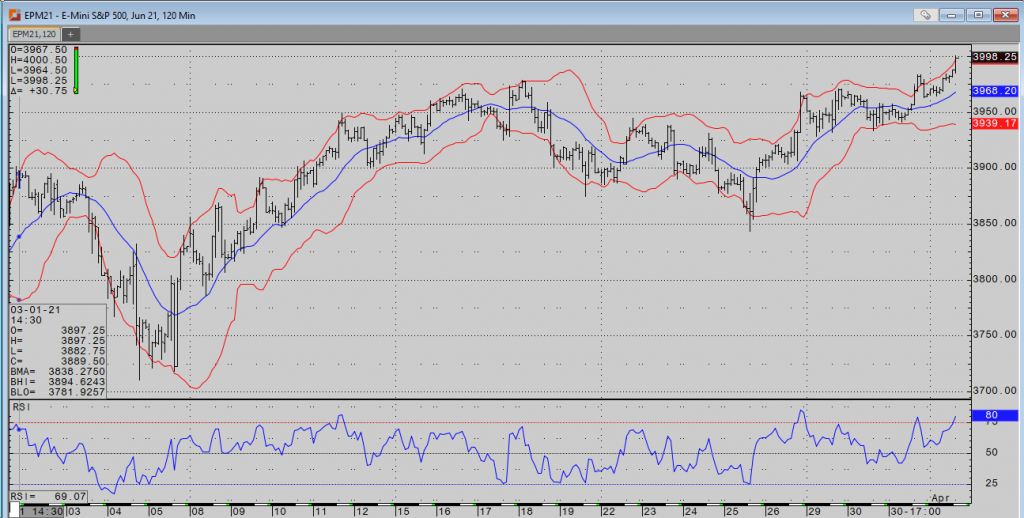

The indices continue to press higher on talks of massive infrastructure spending and falling yields. After creeping north of 1.75% just two days ago, the 10-year yield is now back down to 1.679%. The Nasdaq seems particularly happy about this. June futures are up over 1.5% and trading at their highest levels since 3/2. The June e-mini S&P is up about ¾ of a percent, trading just shy of the 4000 level at 3996.50. The Russel is up a bit over 1%, while the Dow is up slightly (.13%).

On the flip side of all the spending, is the certainty of an uptick in taxes. The focus is once again on corporations and high earners. The latter part was a bit unclear as the story switched from individuals earning over 400k to families and/or individuals earning over 400k. Details seem to be a bit murky, but I’m sure more will be released soon.

The jobs data will be released tomorrow at 7:30am. Equities markets will be open until 8:15, while treasuries and currencies will trade up until 10:15. Stay safe and enjoy your weekend.