The E-mini S&P and E-mini Nasdaq printed new lows overnight. The E-mini Dow was able to hold slightly above the low print from a couple sessions ago. All of the indices have recovered a decent amount since hitting their overnight lows, but are still down anywhere from 0.5% to 1.6% shortly after the open. The GDP number actually came out better than anticipated at 3.5% vs. the expected 3.3%. Consumer spending proved to be the biggest contributor as it came in at 4.0% vs. 3.3% expected. Consumer sentiment is set to come out shortly. Expectations are for a reading of 99.0.

We’re back into earnings season, and yesterday afternoon’s data, highlighted by Amazon and Google, can be partly to blame for the overnight weakness. It is difficult to say what it will take for the market to turn back higher, but perhaps a string of better earnings reports will act as the catalyst. We’ve been treated to several Thanksgiving and Santa Clause rallies in the fourth quarters of previous years. We’ll see if this correction entices more market participants to buy in. Then again, many traders seem to be of the mindset that the levels we’re seeing are still a bit too lofty.

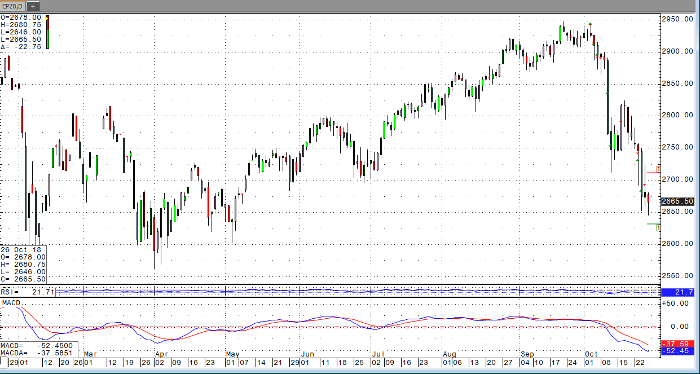

E-mini S&P 500 Dec ’18 Daily Chart