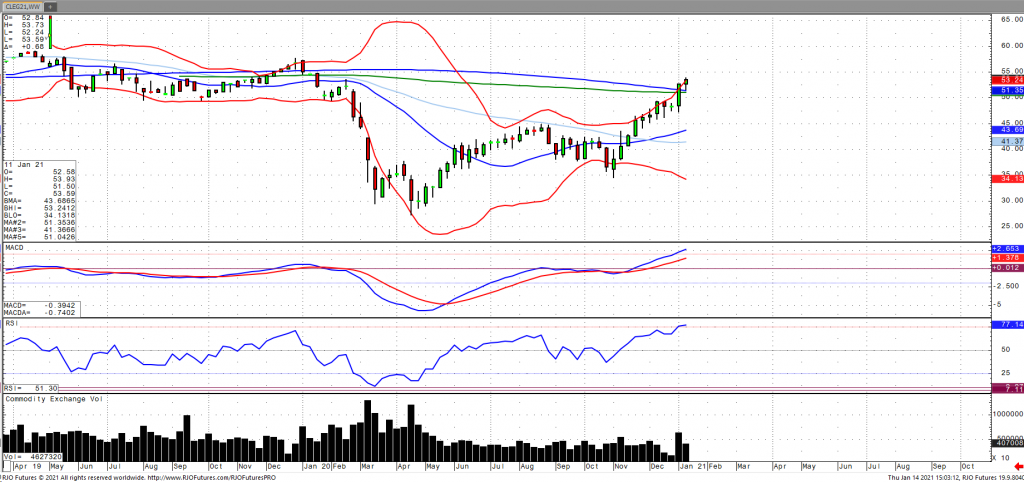

Oil prices have continued to ramp higher as of Thursday afternoon on the back of Chinese 2020 imports jumping 7.3% despite a 15.8% decrease in imports for the month of December as well as an expansion in Chinese refineries. Concerns regarding global demand prospects appear to have been renewed as restrictions and lockdowns across Europe and parts of Asia have come back into effect. OPEC+ left its world demand forecast unchanged, suggesting oil usage will rise by 5.9 million barrels per day to 95.9 million bpd noting, however, that the outlook remains clouded due to the ongoing pandemic. The market remains bullish trend and will continue its inflation higher as oil volatility (OVX) breaks closer to/below 30. However, currently the market signaling immediate term overbought with today’s range seen between 48.65 – 54.49.