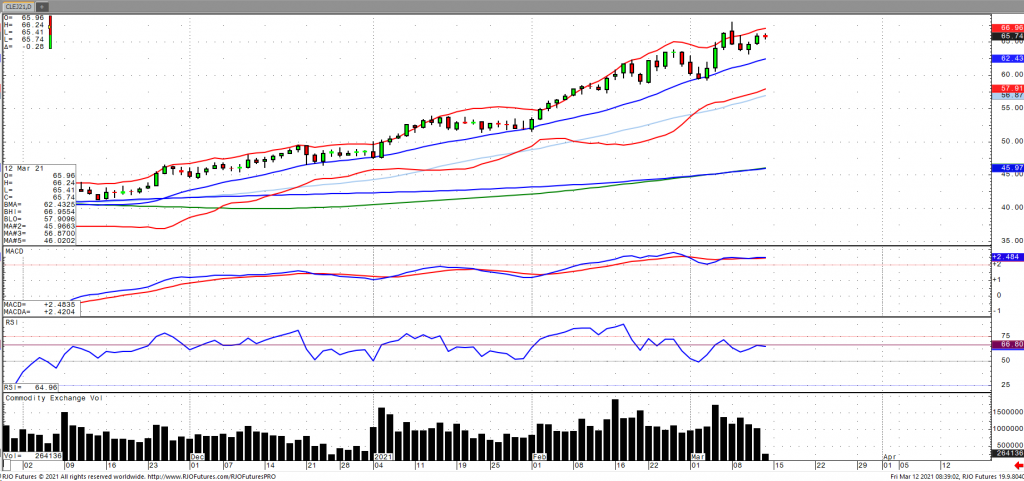

Oil prices are taking a breather after surging more than 2% on Thursday as the vaccine rollout initiative continued to improve the economic outlook, coupled with a sharp drop in weekly US fuel stocks indicating strong demand for end products. US gasoline stocks fell 11.9 million barrels, compared with expectations of a 3.5-million-barrel drop. This was largely offset by a surge in inventories, which rose by 13.8 million barrels, according to the EIA, bringing the total to 46.6 million barrels above year ago levels. Notwithstanding, refinery rates jumped, and refinery margins continue to improve which should help to ease supply and enhance demand prospects. Prices were further supported by reports that Chinese demand for Iranian oil continue to exceed forecasts despite ports now getting backed up, which in turn may dent demand for US supplies. The market remains bullish trend with today’s range seen between 60.76 – 67.95.