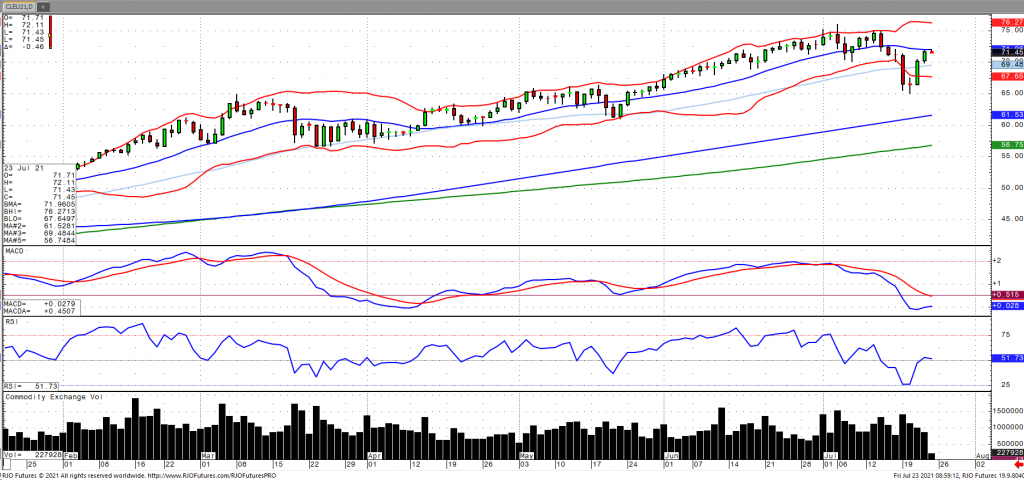

Oil prices are taking a breather after rebounding from their precipitous drop earlier in the week as supply is expected to remain tight as global demand growth continues to recover. This comes amid an agreement by OPEC+ to add 400k barrels per day from August through December. Crude stocks increased for the first time in eight weeks with a build of 2.1 million barrels coupled with a jump in crude imports from Mexico as well as a decline in the refinery rate (but still above five-year refinery average), according to the EIA. The market has largely discounted the impact of the delta variant as well as residual strength in the US Dollar as oil volatility (OVX) has come off trend resistance falling to the mid-30s. The market remains bullish trend with today’s range seen between 66.83 – 77.17.