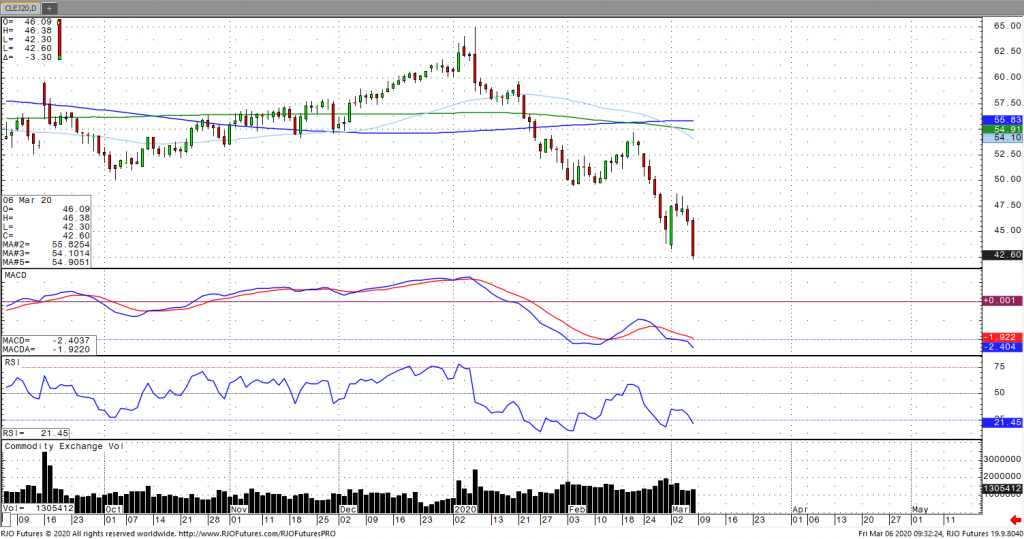

Oil prices dropped over 6% on Friday to multi-year lows following reports that Russia has not agreed to addition production cuts in excess of 1.5 million barrels per day, despite ongoing fleeting demand concerns due to the virus outbreak. Reports that Russia would only comply to extensions but not deeper cuts with non-OPEC states expecting to contribute 500,000 bpd, which would have brought the total to 3.6 million bpd, or about 3.6% of global supply. Despite lowered demand forecasts Russian Energy Minister Novak reiterated that the fallout was too early to assess. Reports by the IMF that the Chinese economy is operating at a 60% capacity has been largely discounted. Weekly U.S. crude stocks increase came in less than expected and the U.S. refinery rate declined, which alludes to the idea that U.S. crude supply may be limited in form. The market remains bearish trend with today’s range seen between 43.02 – 47.71.