By: Alex Turro

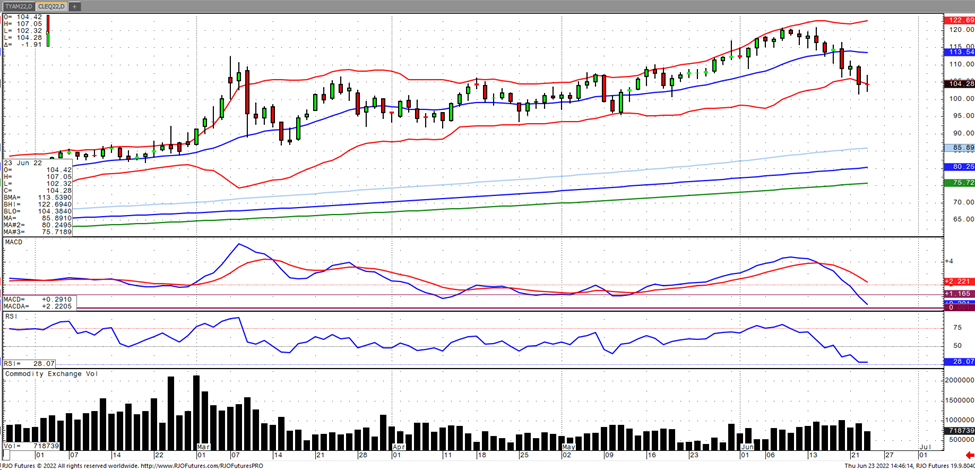

Oil had pared some of its losses but resumed its decline as of Thursday afternoon as concerns mounted regarding the impact of the Fed’s rate hikes on growth prospects and subsequent influence on demand, specifically fuel. Meanwhile on Wednesday, President Biden called on Congress to pass a three-month suspension of the gasoline tax to help fight record high pump prices, which in turn would have a relatively benign influence on the consumer. In addition, the White House has asked oil executives to meet on Thursday to discuss a way to increase production capacity and lower gasoline prices. China and India continue to aggressively buy Russian oil with Asian crude oil imports appearing to, as of now, surpass the record imports set in May. API Weekly crude oil stocks showed a build of 5.6 million barrels with the EIA not reporting this week due to system issues, which leaves a significant unknown as the market continues to experience wide gyrations in price. Open interest for oil contracts has fallen to levels not observed since 2015 with the spec and fund long positioning likely have been reduced to levels not seen since the pandemic. Oil prices are now teetering on a potential reversal in trend, which comes in around $105, with oil volatility (ovx) jumping back into the low 50s with today’s range seen between 103.27 – 115.52.