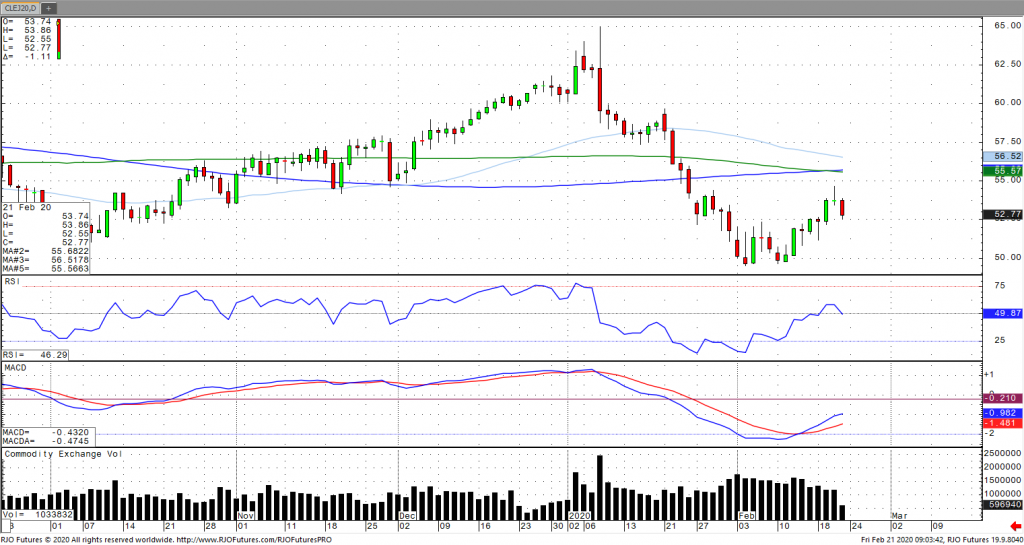

Oil prices fell nearly 2% early Friday amidst an increase in new coronavirus cases as well weakening Asian economic data which softened economic outlook and demand prospects. The upward reversal from yesterday’s high comes among a weekly decline in inventories, with US imports falling and exports increasing. Russian Energy Minister Novak noted on Thursday he does not see a reason to meet prior to the upcoming gathering in early March with expectations of an extension or deepening of the curbs. In addition, cease talks between forces fighting outside Libya’s capital have continued with an agreement potentially ending outages of about 1 million barrels per day, which would only serve to increase pressure on prices. The market remains bearish trend with today’s range seen between 48.63-54.31.