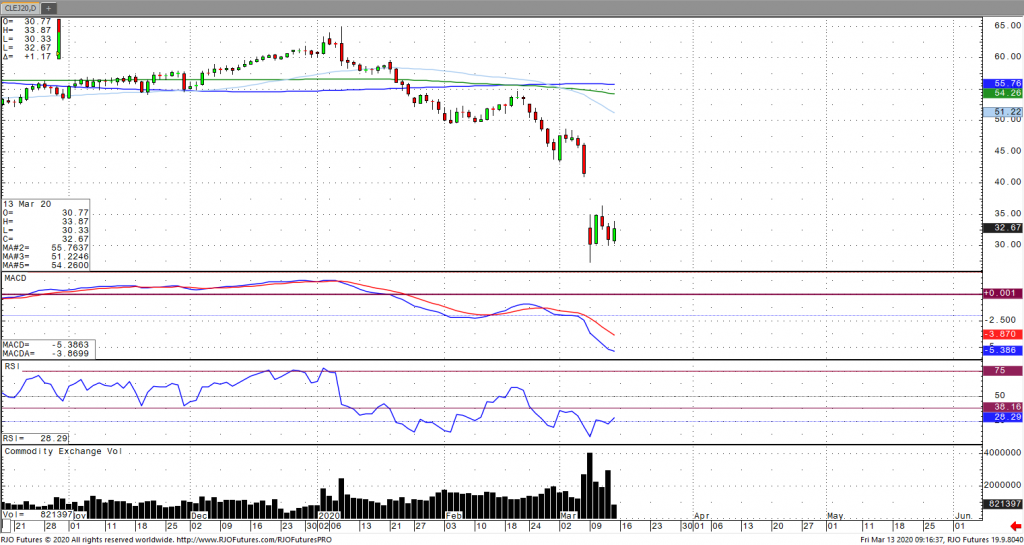

After crashing over 30% in the last week amid a broad decline in global equity markets and the US banning travel from Europe on Wednesday following the World Health Organization’s declaration of the virus a pandemic, prices are experiencing a minor corrective bounce this morning. Oil has been under pressure as OPEC and Russia are threatening to flood the market with oil demand growth forecasts continually revised lower and to their lowest in nearly a decade as the four-year effort to curtail supply is set to expire. Both WTI and Brent are down nearly 50% since their January high and had their largest one-day declines on Monday since the Gulf War. The US Energy Information Administration (EIA) and OPEC had already cut demand forecast even prior to the breakout of the virus with expectations of a further contraction in the first quarter. Weekly inventories displayed minimal effect from the virus as stocks increased by 7.7 million barrels with inventories of gasoline and diesel falling. Oil remains bearish trend with today’s range seen between 28.61 – 35.38.