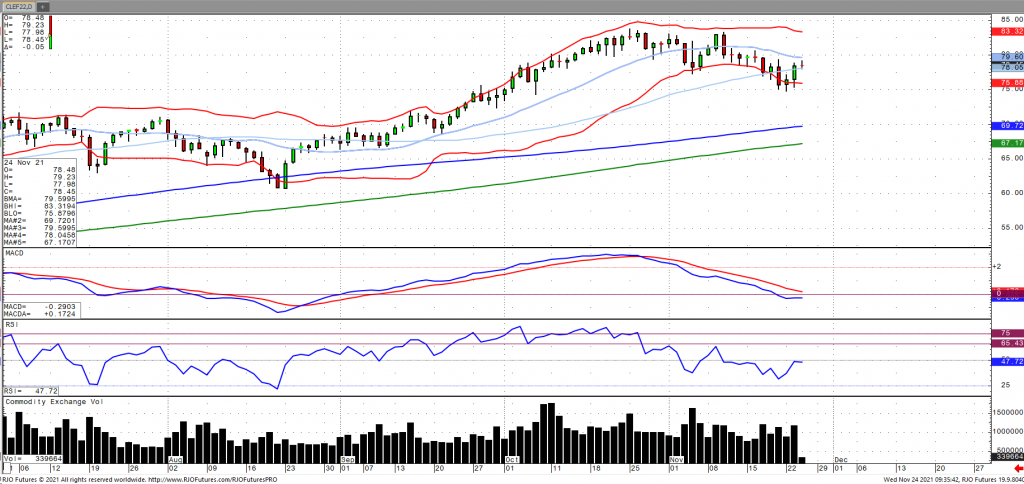

Oil prices fell to around $75 a barrel earlier in the week before moving back into positive territory following reports that the US will lead a global coordinated effort to release their strategic petroleum reserves (SPR). The US is set to release 50 million barrels with 32 million released in the next few months and 18 million of a previous sale. Other countries who have committed include China, India, Japan, South Korea as well as the United Kingdom. The UK has agreed to release 1.5 million barrels with India committing to 5 million barrels with the remaining countries unspecified. This effectively equates to one day’s worth of global oil consumption, which is not going to able to offset this structural deficit. OPEC+ is scheduled to meet next month as they are set to release an additional 400k barrels per day. Oil volatility (OVX) has come off the top end of the range as the market remains bullish trend with today’s range seen between 75.03 – 83.34.