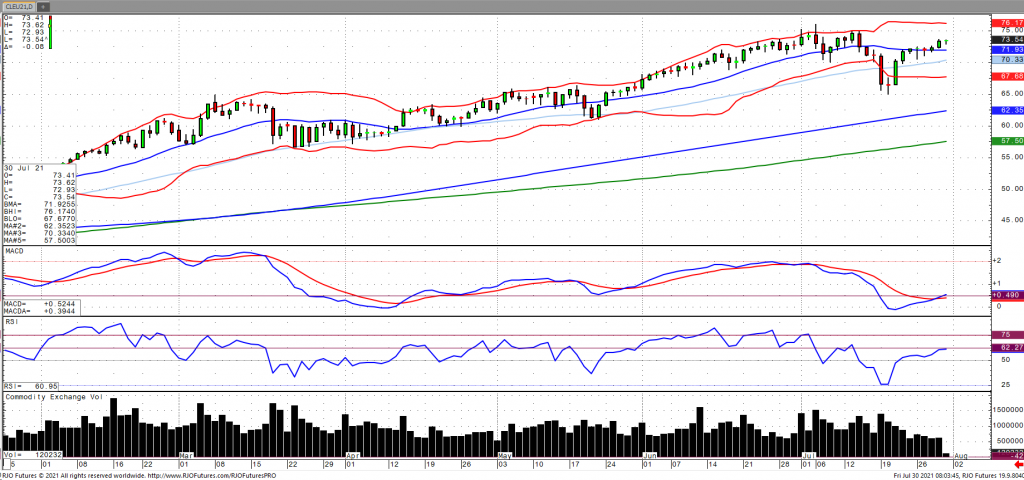

Oil prices rose on Thursday amid a weaker US Dollar as well as carryover from a bullish inventory report with EIA data showing crude stocks declined -4.089 million barrels for the ninth time in the last ten weeks. Production fell 200k bpd for the first time in five weeks with imports falling -590k bpd which was coupled with the lowest inventory reading since January 2020, a further indication of tightening supply. Despite the dampening demand outlook regarding the uncertainty surrounding the delta variant, demand should continue to outpace supply even as OPEC+ is set to bring another 400k barrels back online next month, which is only further evidenced by reports earlier in the week that Indian June oil imports rose 16% from year ago levels. Once more, oil volatility (ovx) has come off trend resistance and continues to break down into the low 30s with the market remaining bullish trend with today’s range seen between 68.07 – 75.83.