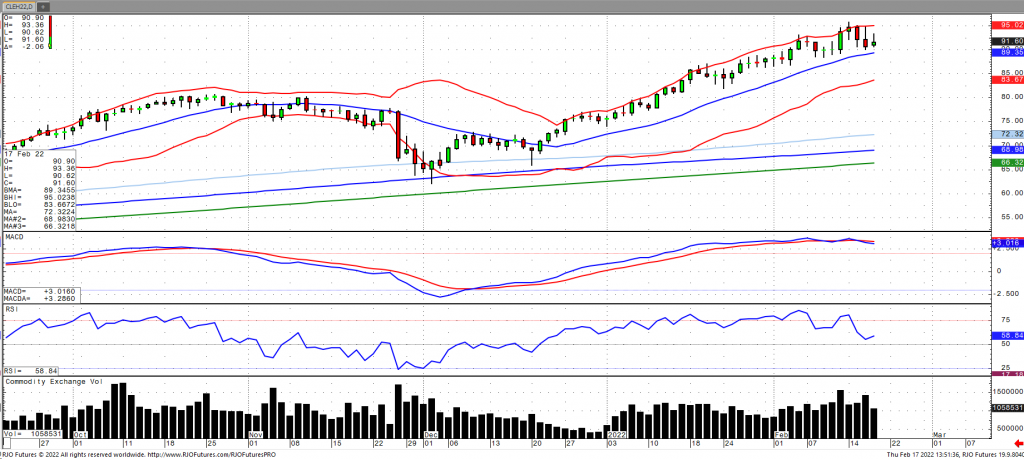

Oil prices have fallen nearly 2% on Thursday as discussions with Iran involving the nuclear deal remain ongoing but were largely offset by heightened tensions between Russian and Ukraine. The US is in the midst of the ‘final stages’ of talks with Iran regarding the 2015 nuclear deal limiting Tehran’s nuclear activity. This comes as South Korea is said to have had talks regarding resuming Iranian oil imports. Moscow announced earlier in the week of a pullback in troops, while western governments have stated that Russia was building up their military presence with a possible invasion imminent and the trade seemingly more focused on possible demand destruction. Weekly inventories showed a build of 1.21 million barrels with the deficit narrowing by -8.378 million barrels and the five-year average narrowing to -48.155 million barrels, according to the EIA. Refinery utilization fell nearly 3%, which was a largely a result of the impact of refinery outrage in Texas at the beginning of last week. Oil volatility (ovx) has jumped to the mid-50s with the market remaining bullish tend with today’s range seen between 87.36 – 95.52.