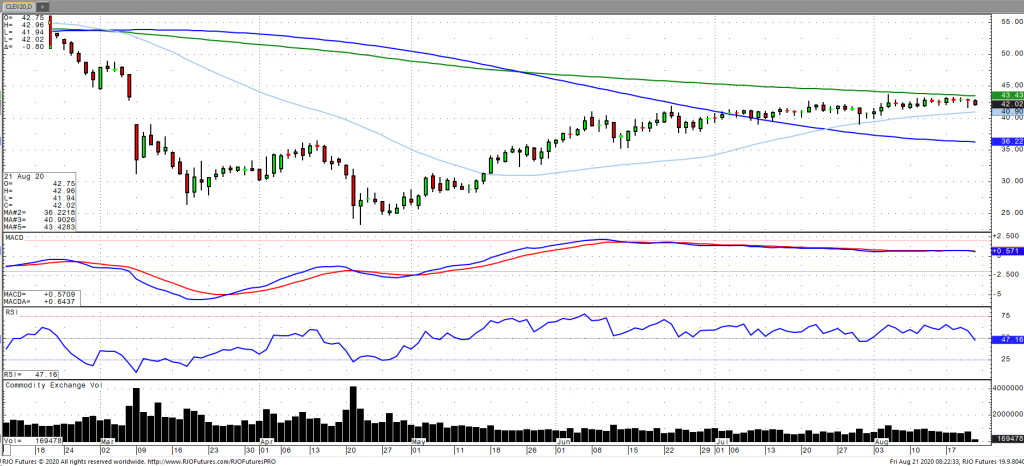

Oil prices are nudging lower this morning after falling nearly 1% yesterday as U.S. jobless claims rose unexpectedly and OPEC+ stating there is a need to address a daily oversupply of over 2 million barrels by some members. OPEC+ earlier this week added that the speed of the recovery process appears to be slower than expected with virus concerns continuing to weigh on the market. US fuel demand fell by more than 2 million bpd to 17.2 bpd according to the EIA with demand down roughly 14% from year ago levels. Oil stocks fell for the fourth consecutive week. The dollar is firming up this morning as well which is continuing to put pressure on prices. The market remains bullish trend with today’s range seen between 41.24 – 43.63.