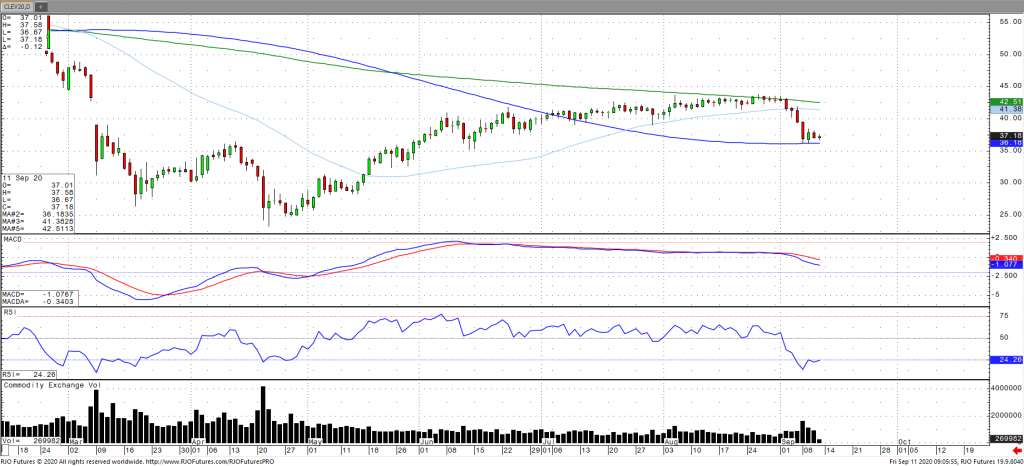

Oil prices are softer once again in the early session after falling nearly 2% on Thursday as the market was pressured by an increase in stockpiles as the virus continues to weigh on demand prospects. US refinery rates continue to be subdued, which would only set to add to oil stocks in the coming weeks. Onshore storage remains near capacity with floating storage seemingly in play as low financing and the current spreads between contracts for delivery are more favorable for the sale of oil later. A monitoring panel of OPEC+ are scheduled to meet on September 17th with the focus on compliance rather than a revision of cuts. Prices are down about 6.5% on the week and headed for a second week of declines with the market now transitioning to neutral trend. Oil volatility (OVX) continues to teeter that bull/bear line of ~54 with today’s range seen between 35.63 – 40.95.