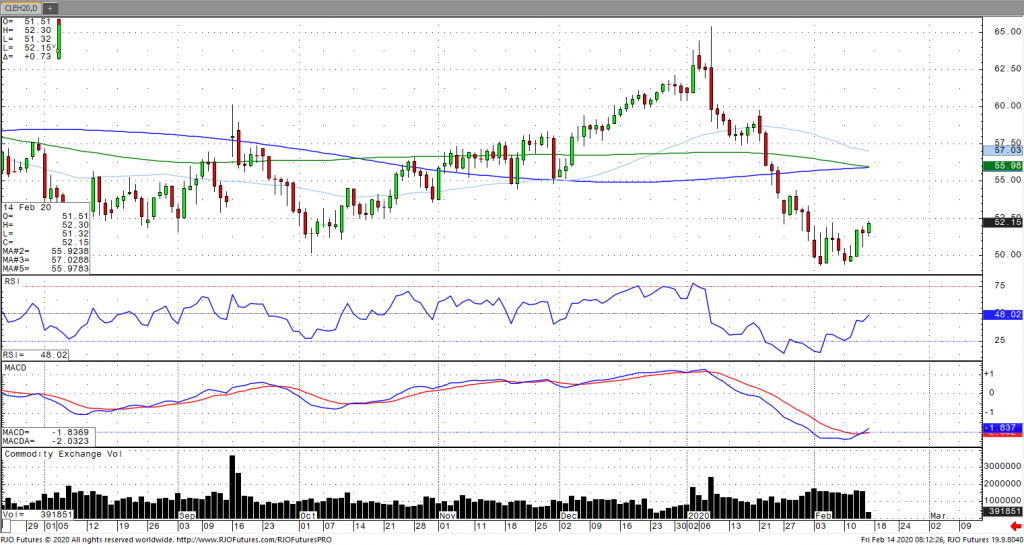

Oil has rallied to a near two-week high despite plunging more than 16% this year amid optimism from the World Health Organization (WHO) that the threat of the coronavirus may be abating. This comes as the WHO reported that the sudden surge in diagnoses does not necessarily imply a surge in new infections. In addition, the International Energy Agency (IEA) revised first quarter demand prospects as well a decline in January OPEC production from 29.44 million barrels per day to 28.86 million barrels per day, which would be the first quarterly contraction in more than ten years. This is coupled with OPEC downgrading their demand growth prospects this year for the sixth time in nine months, this time by 230k to 990k barrels per day, while simultaneously lowering their global economic forecast to 3% this year. OPEC is next scheduled to meet March 5 -6 with deeper cuts likely. Do not discount geopolitical risk factors. The market remains bearish trend with today’s range seen between 49.05 – 52.70.