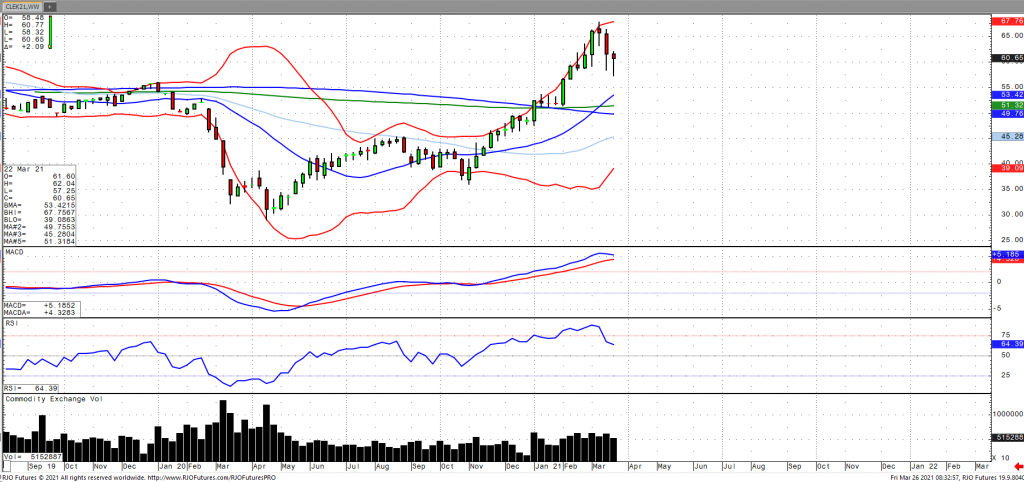

Oil prices appear to be poised for a third consecutive week of losses despite an early lift as concerns that the shipping container that had run aground in the Suez Canal may last for longer than expected, squeezing supply. Renewed restrictions in Europe have added concerns that the global recovery in fuel demand may slow. Oil inventories added to the bearish sentiment as US crude oil stocks ran up to a 30-week high. However, the refinery rate jumped 5.5%, indicating the potential for increased demand for domestic crude. It should be noted that OPEC+ compliance to reduce output came in at 114% last month. Again, most importantly, the push above trend in oil volatility (OVX), which comes in around 48 appears to be more ‘episodic’ and non-trending in nature as the market remains bullish trend with today’s range seen between 56.53 -66.97.