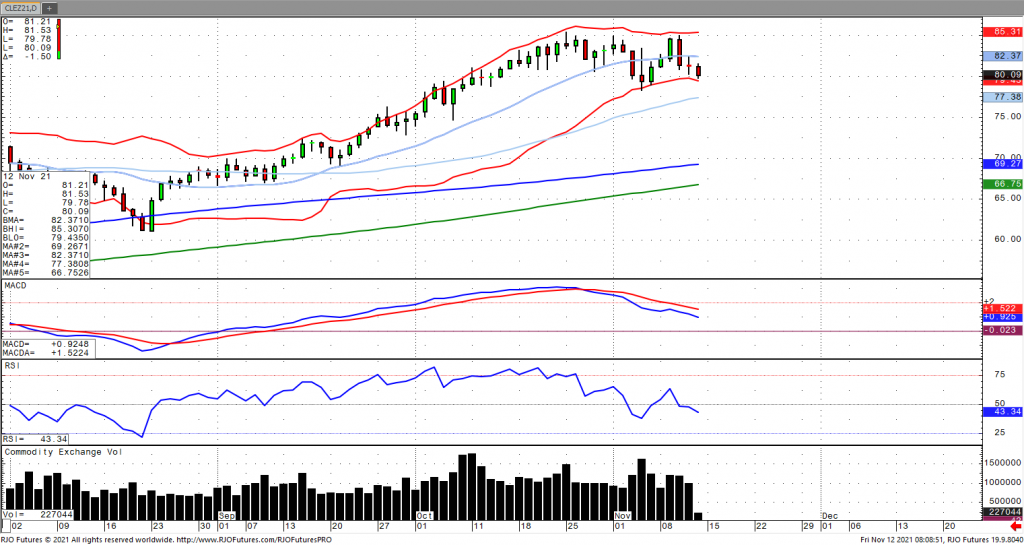

Oil prices have fallen early Friday amid a firmer US Dollar as well as speculation of the potential release of US strategic reserves. OPEC+ noted that it projected its October production to have increased by 217k barrels per day while simultaneously reiterating their objective of returning 400k barrels per day until output is restored. In addition, OPEC+ cut their demand forecast for the fourth quarter by 330k barrels per day from last months forecast. US crude stocks rose 1.002 million barrels for the third consecutive week with stocks now -53.60 million barrels below last year and -30.705 below the five-year average, according to the EIA. Gasoline stocks, however, fell -1.555 million barrels for the fifth week with stocks coming in at the lowest since November 2017. The market remains bullish trend with today’s range seen between 78.37 – 85.81.