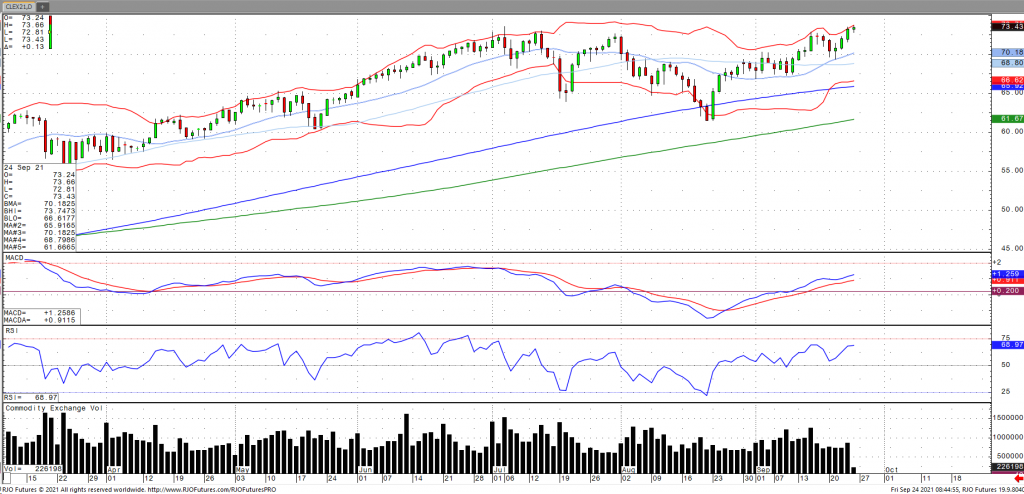

Oil prices ramped up to 2-month highs as of Thursday afternoon and are poised for a third straight week of gains amid the prospect of an improvement in fuel demand as well as a larger than expected draw in inventories, which comes in the face of China’s first selling of public crude oil reserves. Stocks drew -3.481 million barrels for the seventh consecutive week with the deficit increasing to -80.422 million barrels and are now -36.637 million barrels below the five-year average, according the to the EIA. India recorded a 14.2% increase in refinery processing last month, suggesting perhaps a turn in domestic demand. This was strengthened by reports that Indian oil imports came in at a 4-month high with a year over year gain of 3.1%. Oil volatility (OVX) continues to fall to cycle lows (low 30s) with the market remaining bullish trend with today’s range seen between 69.89 – 73.78.