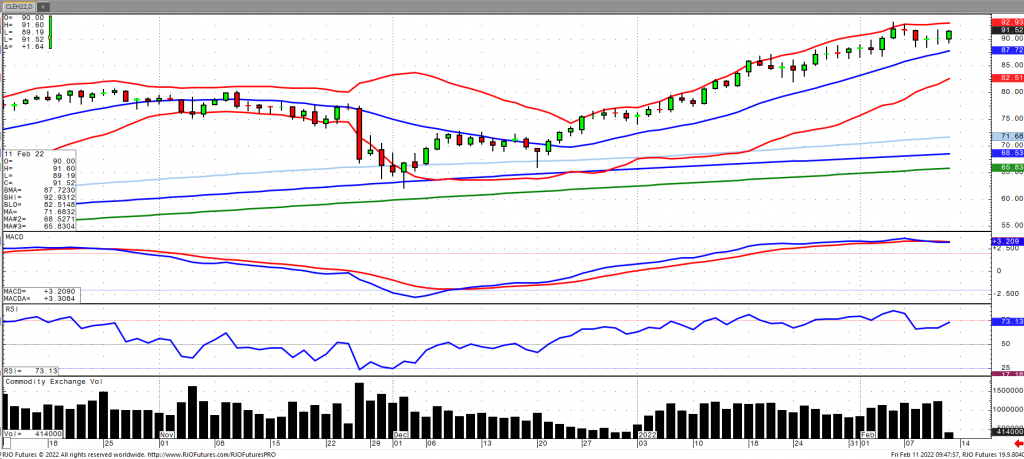

Oil prices are moving higher as of Friday morning but are poised for their first weekly loss after seven consecutive weekly gains as the IEA noted that global supplies continue to remain tight, while simultaneously noting that OPEC+ production came in 900k barrels below their target for January. Moreover, the IEA noted that Saudi Arabia and the UAE could help combat higher prices by providing more supply as they have excess productive capacity. OPEC+, in turn, had an upward revision to demand for the coming year. Nuclear talks between the US and Iran were revived this week with a deal potentially lifting sanctions on Iranian oil, which would ease supply tightness. Crude stocks fell -4.75 million barrels with the deficit narrowing -58.627 million barrels below last year with the five-year average widening to -50.12 million barrels, according to the EIA. This now puts US crude stocks at the lowest since October 2018. Oil volatility (ovx) continues to remain elevated in the mid 40s with the market remaining bullish trend with today’s range seen between 85. 32 – 92.19.