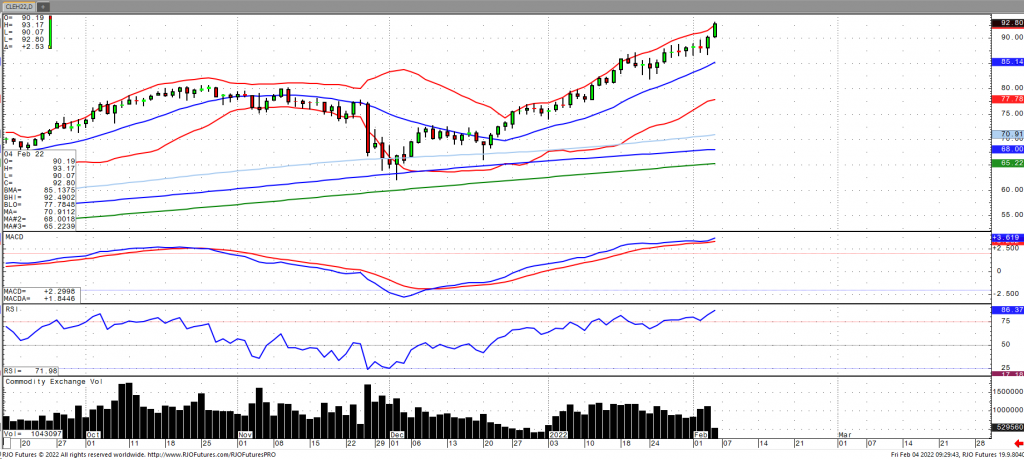

Oil prices have continued their relentless march higher, surpassing a seven-year high and topping $90 a barrel for the first time since 2014. This comes as demand for petroleum products continues to outstrip supply. OPEC+, as largely expected, are going to continue with their gradual increase in supply of 400k barrels per day in March, while reports have shown that Iraq, the second largest oil producer, pumped far less than it’s January quota. Tensions continue to persist in Eastern Europe as the potential for Russian supply disruptions remain, while domestically, the recent winter storm in Texas has temporarily slowed US production and distribution in the Permian basin. Crude stocks fell -1.047 million barrels with the deficit remaining at -60.516 million barrels and the five-year average widening to -42.201 million barrels, according to the EIA. Strategic petroleum reserves (SPR) fell -1.19 million barrels to 588.91 million barrels, reaching the lowest since 2002. Oil volatility (ovx) continues to remain relatively elevated in the low 40s with the market remaining bullish trend with today’s range seem between 83.17 – 91.79.