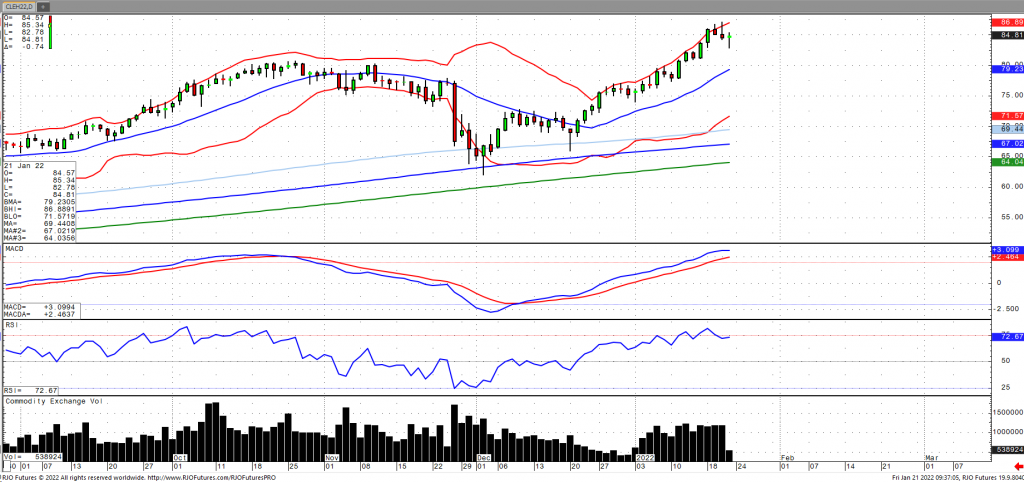

Oil prices are coming off seven-year highs following some profit taking as short-term supply disruptions have continued to underpin prices. On Tuesday, a fire temporary stopped flows through a pipeline in Iraq’s Kirkuk. In addition, an attack on Yemen’s Houthis on the UAE heightened geopolitical risks. The market was also supported by reports that OPEC+ fell 800k barrels per day below its December target. The IEA upgraded their demand forecast for 2022 while noting that the oil market could be in a surplus for the first quarter. Oil inventories rose 515k barrels for the first time in eight weeks with stocks now down 72.75 million barrels below year ago levels and 38.10 million barrels below the five-year average. Oil volatility (ovx) has rebounded into the upper mid-upper 40s with the market remaining bullish trend with today’s range seen between 77.03 – 87.24.