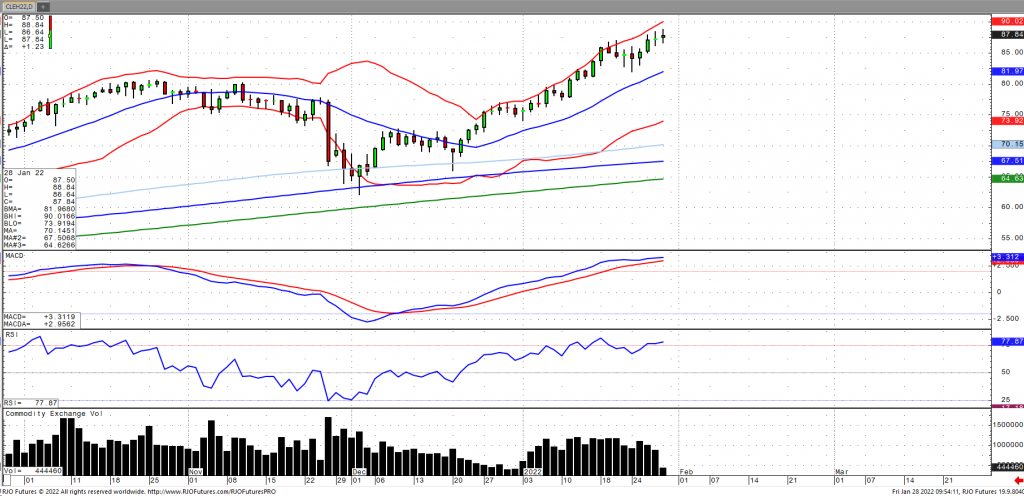

Oil prices have continued to ramp higher and are poised for their sixth consecutive weekly gain as concerns over tight supplies continue amid higher fuel demand. Prices have gained nearly 15% YTD amid geopolitical tensions between Russia and Ukraine as well as threats to the UAE from Yemen’s Houthi movement. This comes as OPEC+ is observed to continue with their existing plan to gradually increase production with the market looking ahead to the upcoming meeting on Feb 2nd. Regarding demand, China, the world’s largest importer, is expected to rebound by around 7% this year, reversing last year’s decline. Crude stocks rose 2.377 million barrels recording the second consecutive build after falling for eight weeks in a row, according to the EIA. The year over year deficit fell -12.107 million barrels to -60.463 million barrels with the five-year average falling to -37.284 million barrels. Oil volatility (ovx) continues to remain elevated and above trend with the market remaining bullish trend with today’s range seen between 80.73 – 87.76.