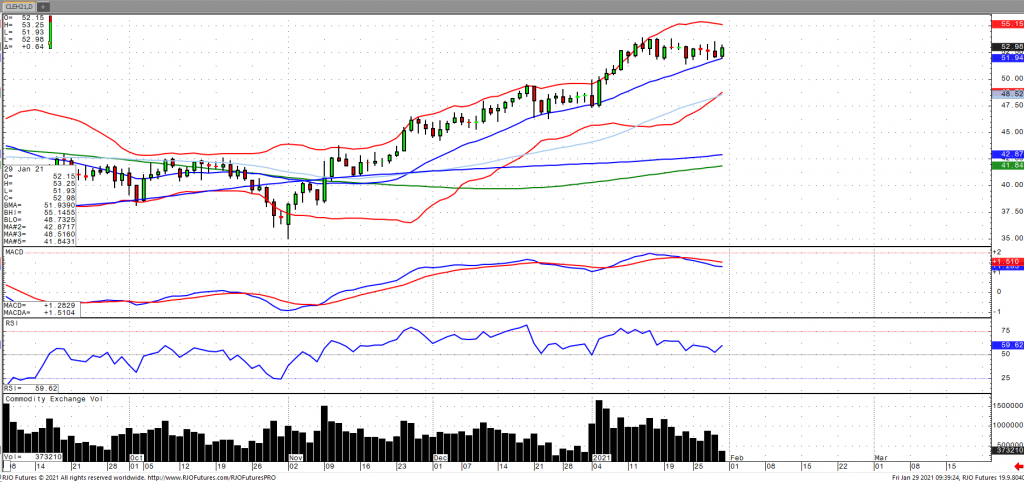

Oil prices are edging higher early Friday as the market assess the ongoing changes in supply and demand fundamentals. Saudi Arabia is expected to extend output cuts by 1 million barrels per day in February and March with OPEC+ supply cuts set to rise to 8.125 million bpd in February. US oil inventories posted a significant decline of 9.9 million barrels, according to the EIA. In addition, Chinese refinery run rates increased this week with Indian demand expected to return to pre – virus levels this upcoming quarter. This helped to largely offset concerns regarding the ongoing recovery in fuel demand amid stalling vaccine rollouts and new virus strains. The market remains bullish trend with today’s range seen between 52.00 – 53.73.