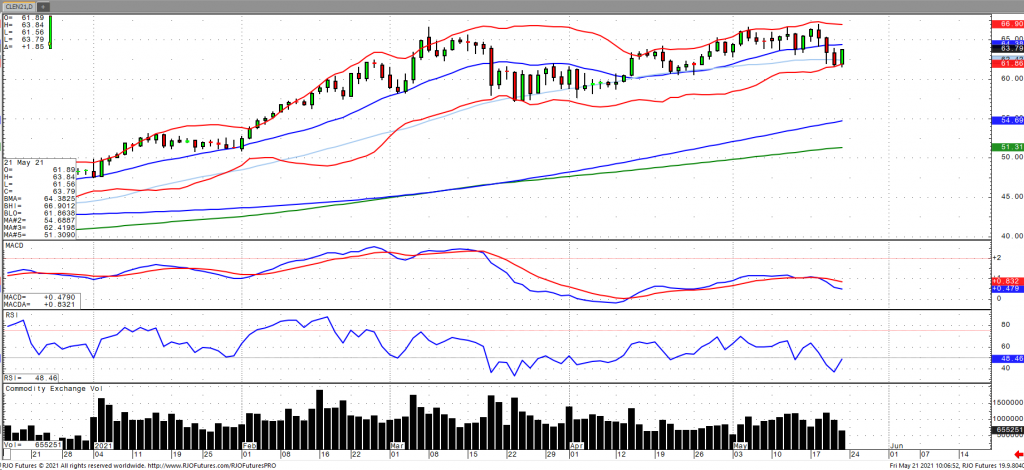

Oil prices are rebounding off a three-session low as reports that Iranian oil is set to come back online by as much as 500k barrels per day (pending sanction relief) as well ongoing demand concerns from Asia (India). This comes amidst reports that Indian oil imports rose by the most since Nov 2019 as global oil supply/demand is expected to settle out for the rest of the year. OPEC+ compliance came in at 113% for April just as production restraints are set to be lifted at the beginning of June. A supportive development comes from the EIA this week as implied gasoline demand readings came in at the highest since the onset of the pandemic. Oil continues to signal bullish trend on the back of falling volatility (OVX) with today’s range seen between 61.73 – 67.72.