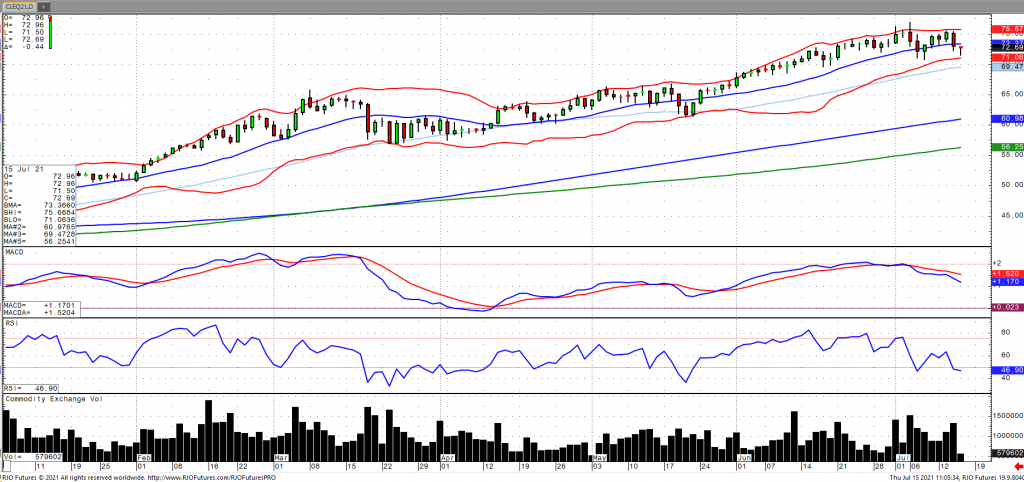

Oil prices have extended their sell off early Thursday but are coming off their low as the market assess the prospect of an increase in supply as OPEC+ agreed to a comprise coupled with an unexpected increase in fuel stocks. Weekly inventories saw its largest decline in oil stocks in months with its eighth consecutive draw of -7.896 million barrels and gasoline stocks building +1.1.038 million barrels despite a drop in refinery utilization, according to the EIA. Notwithstanding the prospect of more supply, demand growth should continue to outpace with China reporting record processing in June. Oil volatility (OVX) continues to remain relatively subdued with the market remaining bullish trend with today’s range seen between 71.64 – 72. 35.