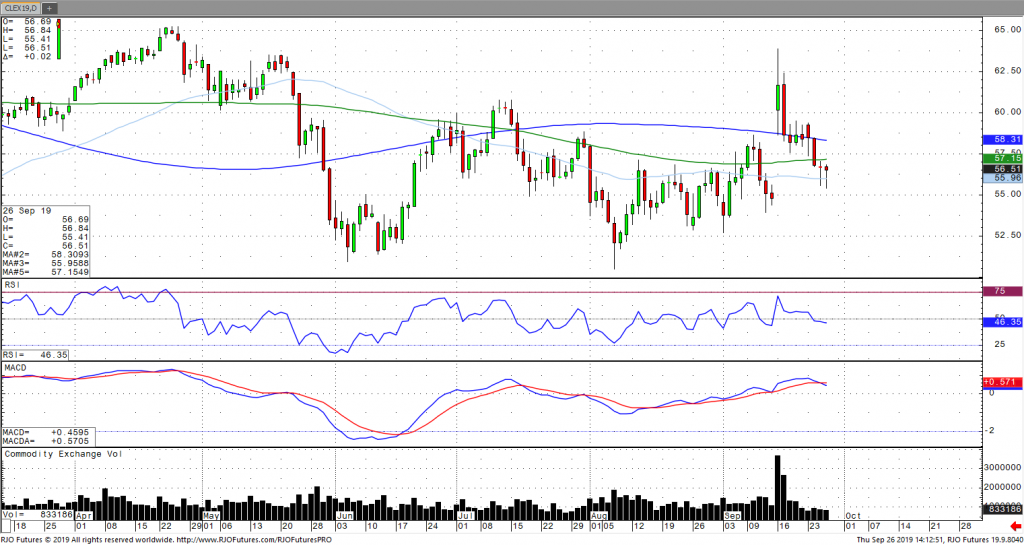

Oil prices have continued to move lower amidst the second weekly surprise build in inventories and have softened back to their pre-attack levels following the attack on the Saudi Arabian oil facilities. Aramco has reported that output has improved to 8-million barrels per day, although the figure appears overstated and the projected timeline optimistic with full production capacity viewed at 12.5 million barrels per day. Although U.S. production has matched record levels of 12.4 million barrels per day and despite Iraq, UAE and perhaps Russia being able to add production, Saudi Arabia is the central spare capacity provider pending any subsequent attack or supply disruption. While global demand concerns continue to persist, geopolitical risk remains high and far from diffused with Iranian pressure increasing with the EU now condemning the attack. The market remains bearish trend with today’s range seen between 54.00 – 62.36 with trend resistance seen around 58.44.