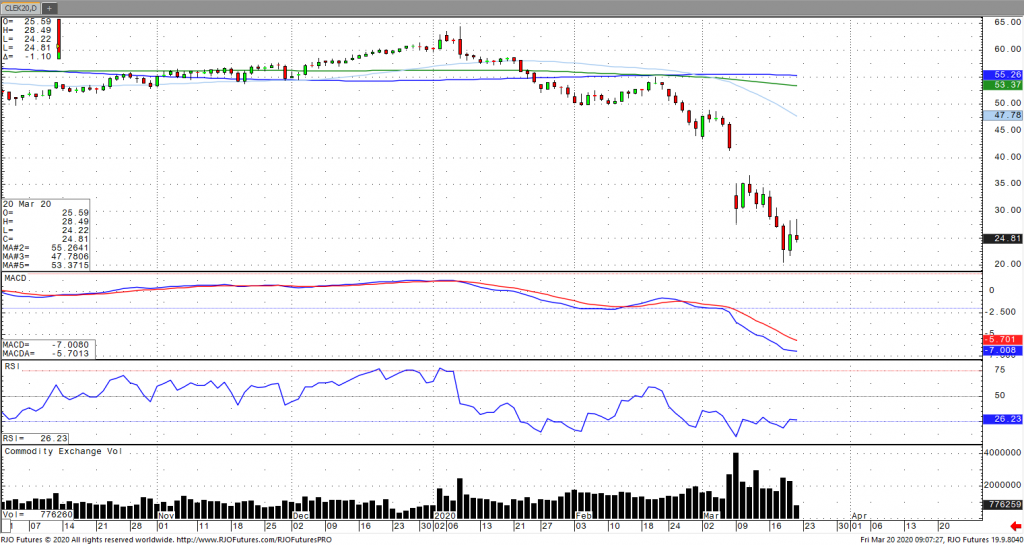

Oil prices are starting to come off their steep surge on Thursday following a 24.4% collapse on Wednesday as prices have been weighing supply and demand prospects. With demand forecasts slumping and tensions between Saudi Arabia and Russia escalating following the failed OPEC meeting in early March, prices have now slid nearly 60% this year. President Trump noted that the US could intervene in this ongoing price war, which contributed to yesterday’s gains. Meanwhile, OPEC production cuts are set to expire at the end of the month. Saudi’s Aramco has output at a record 12.3 million barrels over the coming months, however, both Saudi Arabia and Iraq cut rebates on freight costs, effectively lifting prices. Look to short bounces at/near top end of the range as the market remains bearish trend with today’s range seen between 21.29 – 30.34.